“Davidson” submits:

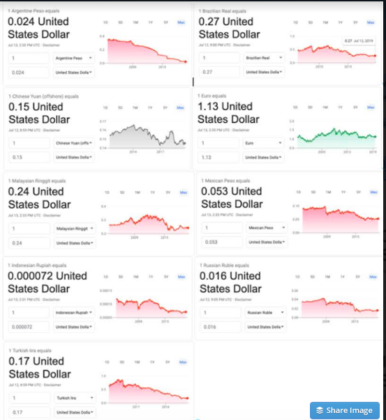

The impact of autocratic/socialistic and basically corrupt governments taking value from its citizens has always resulted in capital fleeing those countries to safer havens, i.e. gold or assets priced in safer currencies. Recent US$ strength beginning with Russia’s invasion of Ukraine and then more recent threats from No Korea, Iran and China miss the earlier individual currency declines relative to the US$ as their respective governments sought to bend economic activity of their citizens to boost leadership’s wealth. The following individual histories of US$ to specific currencies come from google.com currency converter. They show relative US$ strength began long before 2014 for each. If one reviews historical events, weakness in many of these coincide with government self-enrichment activity through violation of property rights which caused capital flight out of the respective country. Some which were recognized as an ‘Emerging Market’, benefited from outside investors seeking perceived higher returns in these countries which stimulated the monetization of previously illiquid assets. Monetization permitted previously illiquid capital to exit these countries at a more rapid pace.

Capital flows to Western countries has increased as options to Chinese investors have improved. Cryptocurrencies have been used as one of the transfer media, but dumping steel, aluminum, refrigerants other chemicals into to Western countries have also been used. These investors have sought out real estate and Sovereign debt deemed conservative investments and benefited as the Western currencies have appreciated vs. Emg Mkt currencies. The US$ strength has proven most beneficial.

Should US$ initiatives to lower global tariffs prove successful, capital flows to US$ and other Western nations could rise with their improvement in global export activity.

To access member-only content FREE for 5 days, please follow this link