“Davidson” submits:

Tariffs and Inflation. The Inflation Bogyman that is not there:

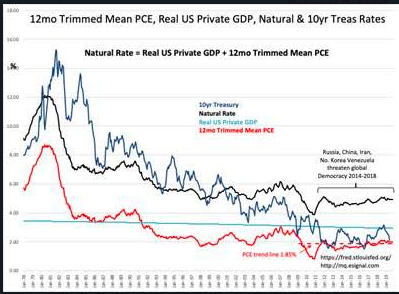

The consensus interpretation of tariffs is that higher tariffs are inflationary for the country imposing them. In the current market, US tariffs on imported Chinese goods should be inflationary because the tariffs are on many common items used in every day activity. The US has ramped its Chinese Customs Duties in 2018 from a level of ~$40Bil/Q to ~$75Bil/Q which amounts to ~$140Bil/Yr additional collections. Consensus thinking is that this is a direct cost to US consumers. However, US inflation remains unmoved at ~2%. Why?

China is a managed economy built on mountains of debt which has not followed many of the ‘Economic Rules of the Road’. Much like the ‘Japan Inc’ phenomena of the 1980s, ‘China Inc.’ is based on government/corporate/military coordination to force economic outcomes believed to be favorable to its leaders. China’s “Made in China 2025 Plan” is a goal of world domination. China is a Command Economy heading rapidly towards autocratic control by its current leadership. What they failed to perceive is that no country can dominate the world. Each country’s success is dependent on the success of its trading partners. By attempting to dominate all others through low cost labor and intellectual property theft, China has found itself in the precarious position of dependency on the consumption of its largest trading partner to succeed. In order to keep its citizens employed, China has been forced to lower its profits to keep prices to the US, in the face of higher tariffs, competitive. China is desperate to maintain the US as a customer. Net/net, tariff costs have not been passed to US consumers but absorbed by ‘China Inc.’ China is in trouble.

Command Economies can behave like China for a period but they always fail because they violate the basic rules of economics. True economic growth derives from win-win transactions in which each party contributes value to the other leaving both parties with higher standards of living. Jointly beneficial activity is a process of a converting human creativity to ‘societal equity’. The US Free Market has operated through win-win transactions before the creation of the US Constitution. The US Constitution is “The Golden Rule” converted into a self-governing covenant.

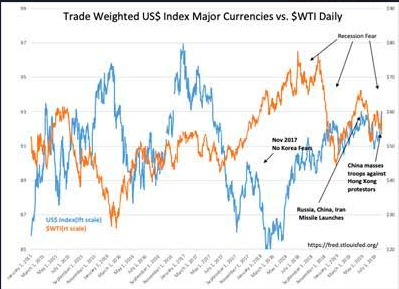

China has moved troops near Hong Kong to counter pro-democracy protesters. Some expect martial law to be imposed shortly. The US$ has risen sharply as capital shifts to US$ denominated assets.

US Economy Remains on Trend:

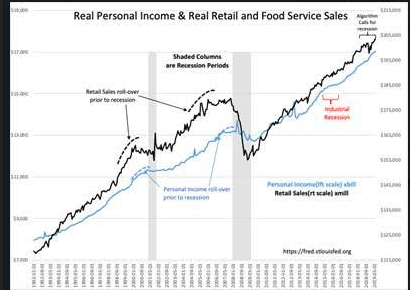

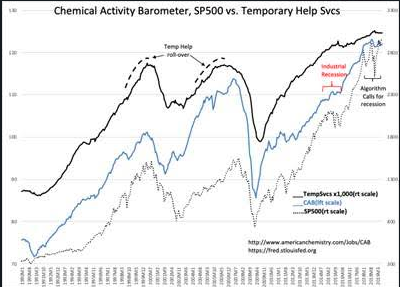

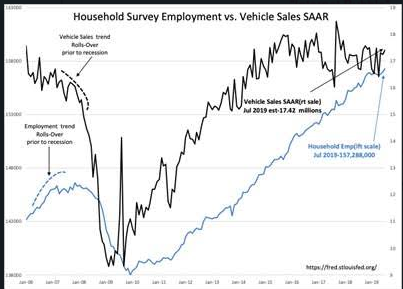

US employment reached a new high July 2019 with vehicle sales holding at current levels. Temp Help has stalled but Real Retail Sales and Personal Income continue to rise. This looks quite positive in the face of the current round of pessimism which has been present since Jan 2018.

Market Valuation is not Excessive:

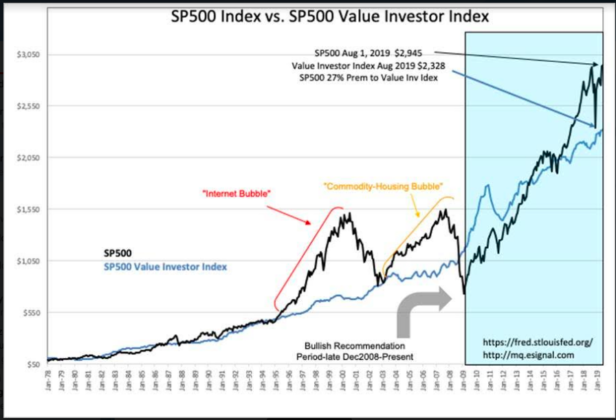

The Value Investor Index remains 27% premium to the SP500. Not excessive. This is a fundamental index based on the US Real Private GDP trend, the 12mo Trimmed Mean PCE and the long-term earnings trend of the SP500. Excessive market valuations correlate with premiums of 60%-100%+ and a high level of speculation coupled to enthusiastic market psychology. The term ‘euphoric’ does not describe today’s investing environment. Investors have been pessimistic since Jan 2018 with multiple market sell-offs on anticipated economic weakness which has not come to pass.

The news has been chock-a-block with reasons to be pessimistic. Pessimism remains in current market prices. Do not expect this to change much the next few years as China grapples with deep missteps vs its citizen’s desire for Democracy. Nonetheless, markets rise in pessimism as investors come to realize that things are not as bad as they thought.

Markets should rise from current levels as pessimism eases and economic activity continues.