“Davidson” submits:

Not all markets are equal. Advisors typically recommend that investors balance portfolios globally. Now that sufficient history is available one needs to question this routine recommendation. Market history from 2008’s ‘Great Recession’ is instructive. Intl Markets as represented by the MSCI All Capital World Index excluding the US(ACWX) have been recommended as higher growth markets(especially the EmgMkts asset class) for more than 20yrs. This recommendation is based on Modern Portfolio Theory(MPT) which Harry Markowitz developed in 1952.

The back story is that Markowitz, a mathematician, created a statistical model which defined volatility as ‘risk’. His view sought to take human psychology out of the investment decision making process using an analysis of market price-trends. Over the decades MPT gained favor with pension and endowment managers as ‘the scientific approach’ and has evolved into the emergence of Hedge Funds and the Financial Planning industry that is now ubiquitously applied by computers to hundreds of millions of retirement plans. Today much of short-term market pricing is driven by algorithms coupled to past price trends which are believed by their designers to forecast future trends. Many have come to believe that computer guidance eliminates the variables of human psychology. The facts are that algorithms designed by humans carry all the biases of human perception. Because the output is computer driven, many have come to believe it is bias-free. Sadly it is not and MPT ignores key fundamentals.

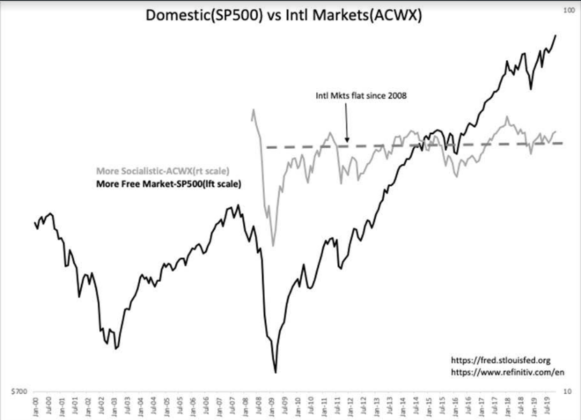

The heavy reliance on MPT driven allocations and periodic rebalancing between specified asset classes ignores the fact that market performances are unequal. When the ACWX is compared to the SP500, the SP500 out-performance is unmistakable. Investors should question “Why is this so?”

The SP500 out-performs all Intl markets longer-term. The answer is more complex than a simple note can do justice. But, the essence of the explanation is that the US is the only Free Market globally. The US marketplace is fundamentally different. Everywhere else markets are riddled with government social engineering policies which restrict the freedom of investors to allocate capital to the opportunities with the highest expected returns. Even with a history of US political schemes to drive economic activity to achieve political/social outcomes, the US has always found the Free Market lane.

The reason for this can be found in the Amendments 1-5, https://nccs.net/blogs/americas-founding-documents/bill-of-rights-amendments-1-10 which read as a non-religious based ‘Golden Rule’ for self-governance. No other country has enshrined the responsibility for fairness to others in the hands of its own citizens. Fairness between Individuals is imbedded in the US culture with more than 200yrs of legal testing. The rights of a single individual more often than not take precedence over the desires of government or social/wealthy elites. Most today remain unware of A.L.A. Schechter Poultry Corp. v. United States, 295 U.S. 495 (1935). https://en.wikipedia.org/wiki/A.L.A._Schechter_Poultry_Corp._v._United_States The Supreme Court upheld the rights of individual choice and in effect overturned the broad government control assumed during the Great Depression in the National Recovery Act 1933 a major component of the New Deal.

The US Free Market is so culturally imbedded by more than 200yr of experience/practice that the majority take it for granted. Many have likewise taken for granted that Free Markets would follow internationally with the expansion of global trade. That this long-term perception is not valid can be seen in the SP500 vs. AWCX performances. Markets reflect how capital is treated by their governments. There is no market equal to the US. Only by delving into the basis of US self-governance does it become obvious that the US is the only market which makes sense for investors.