“Davidson” submits:

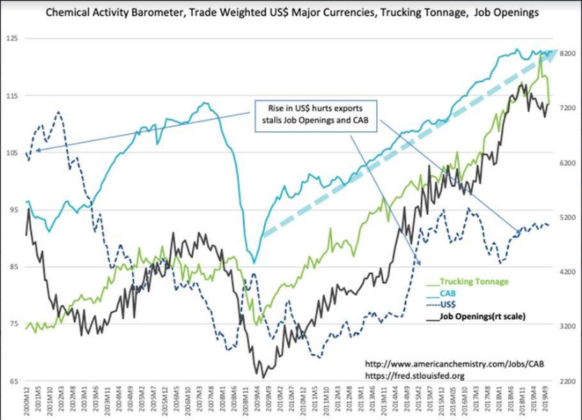

Chemical Activity Barometer(CAB) reported at 122.67 is approaching the Sept 2018 high of 123.10 with previous months again revised higher. The Trucking Tonnage Index(TTI), a much more volatile index due to data collection, dropped 3.5% to 113.5 from its May 2019 high of 122.1. When in doubt, the CAB, an indicator with inception from 1919 and much less volatility is the preferred indicator. The recent rise in Job Opening data correlates with a rise in the CAB which are in turn correlated with periods of strength in the US Dollar(US$) making US exports more expensive/less attractive in global trade. Slowing in US manufacturing and subsequent slowing in US GDP are likewise strongly correlated.

Taken at face value, many have interpreted these trends in conjunction with the recent yield curve inversion. Not part of the consideration are the many company initiatives long in process to implement ‘Lean Mfg.’ techniques geared towards continuous-improvement which continuously lowers costs to maintain global competitiveness and to nimbly respond to unanticipated events. Every sector in the US has adopted/developed some form of “Lean” developed at Danaher in the mid-1980s. The more recent period of US$ strength has been accompanied with US tariff initiatives which have likely contributed to a slowing manufacturing sector. US$ strength and declining 10yr Treas yields which caused the inverted yield curve are a result of capital streaming into the US. The inverted yield curve today is one of the very few times it has not been associated with slowing economic activity.

US companies successfully adapted to the earlier 2014-2016 period of US$ strength helped by pro-business regulation and tax policies not present prior to 2016. Manufacturing productivity per employee was in an uptrend 2017 to early 2019 when a short decline ensued. This could be the impact of the yield curve or tariff initiatives. It is too early to ascribe which may be dominant, but experience suggests that the recent yield curve inversion is the most likely culprit as tariffs in place the previous 12mos did not have a noticeable impact.

Recently, modifications to Dodd Frank’s one-size-fits-all’ regulations treating Money Center and Community banks with identical restrictions have been introduced to restore Community banks back to their historical position as primary community/home mortgage lenders. Should this deregulation prove effective, the long drought in availability of single-family mortgages and single-family home building could see significant stimulation. Based on the regulation reduction regime thus far implemented since 2017, in my opinion, we are very likely to see continued economic expansion from these new initiatives which may last several years.

Equity prices should rise significantly the next few years as reports continue to be better than expected.