“Davidson” submits:

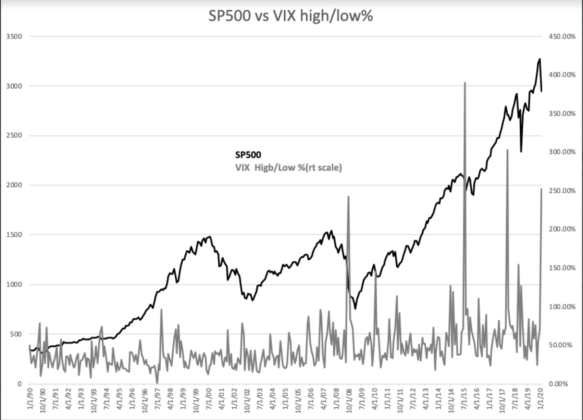

VIX measures forward Selling vs Buying psychology as reflected in options activity. The monthly spread between VIX highs and lows calculated as a % reflects the change in market psychology for the month towards pessimism. Today’s 252% is in response to the coronavirus fears. It reached 302% Feb 2018 with a FAANG/Tech sell-off and 389% in Aug 2015 on a rising US$ and $WTI sell-off. These 3 peaks, dwarf the 242% peak Oct 2008 as investors responded to Sub-Prime Crisis. The VIX is associated with market lows when readings are this extreme, but not with mathematical precision. The lows could in hindsight be today or may be next week or next month.

Either way it occurs, economic activity remains in a decent uptrend intact since 2009 and has never turned negative with the VIX or any other market psychology measure. Markets have never reached their cycle peaks with sharp turns in economic activity. It takes up to 24mos for economic trends to turn lower after a period of expansion and investors have never anticipated correctly the major cycle tops. They have always responded after the fact.

Today’s market while looking scary is not driven economic trends. We are only 2yrs into recent US policy initiatives including major reductions in regulations and taxes that in the past produced significant economic stimulus lasting several years. The fear of coronavirus impacting traders ignores the typical healthcare response any new illness receives which like Ebola, SARS and MERS proved fears were overdone relative to the health/economic impact. Always lost in the early spread of fearful news have been the few reports of medications or actions to limit the threatened damage of any unfamiliar illness. Today, there are multiple efforts underway. In the US, those in our healthcare system are being treated successfully with fluids and rest. The most ill have recovered with the use of non-approved existing drugs under the new “Right to Try” law. https://en.wikipedia.org/wiki/Right-to-try_law This anti-viral is being rapidly produced in China and the US to expand its use.

Even though the past never repeats, we can trust that society has always met apparently insolvable issues with innovation simply because this what we have done. That there is a solution that works has already been reported but has not gained traction in the media. Once it gains media traction, market pessimism will peak, rapidly retreat and in what appears to be ‘in the blink of an eye’ investors will turn to economic trends as the market driver. It is impossible to when, but that we always make this transition is the stuff of the historical record.

https://www.investopedia.com/terms/v/vix.asp

What Is the CBOE Volatility Index (VIX)?

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments. It is also known by other names like “Fear Gauge” or “Fear Index.”