“Davidson” submits:

Markets are not what things are worth but what we as investors believe them to be worth. Keep this tenet in mind and the fact that no two investors think exactly alike or invest alike and one will be well armed to navigate market longer-term. Market psychology is the driver of market prices. It is why we can have issues priced at 600x Revenue with negative Cash Flows and Net Income while others are priced at 0.1x Revenue and Net Income equaling their share price, i.e. Price/Earnings(PE) = 1. Eventually prices rise so high that these shares no longer command investor attention and investors shift to companies with measurable earnings which are building shareholder equity. The high-fliers, another moniker for highly valued issues, find favor with rising-price-trend Momentum Investors who have a particular trust in Efficient Market Theory. They believe that prices reflect fair value all the time. There are times when this type of thinking dominates market indices as we are seeing today. These periods fade when Momentum favorites eventually fail to continue to produce the favorable headlines which got them noticed initially.

Markets are never as simple as the media claims. Markets are always composites of differing opinions. More than that, having evolved into a more globally connected financial system the past 25yrs has brought into US markets the influence of culturally different perspectives. The US market is now impacted by global policies and perspectives which make market pricing closer to a market-of-markets with an even more complex mix of participant aspirations. While this influence has always been present to some degree, the response to COVID-19 shows just how strong this influence has become.

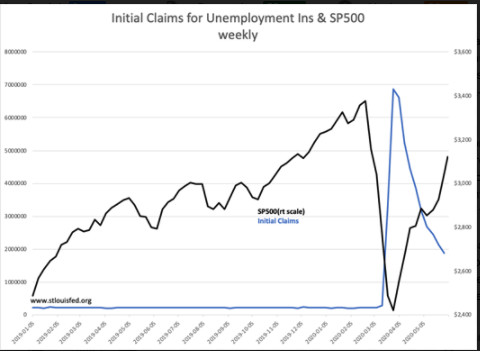

COVID-19 caused governments to shutdown economic activity which produced a ~40% collapse in the SP500 in a record setting rout. Now we are witnessing a record-setting rebound as Initial Claims for Unemployment in the US is less-worse than anticipated. Even though we speak of the ‘market’ as if share-performance was uniform, it is not. The issues labeled as high-fliers, the Momentum Issues, held up much better than the average issue. The reason for this comes from the disparity with which computer algorithms treat issues based on how the algorithms are programmed. Typically, algorithms buy rising price-trend issues and sell falling price-trend issues using a Relative Strength measurement of individual performance vs. the overall market index. When the market collapsed in March, algorithms favored buying very large capitalization issues in uptrends or roughly the top 20 or so issues. The rest they sold down as a hedge with the bet that smaller issues would fall more than larger issues in a general market correction. This type of activity is a reason smaller companies with good earnings reports fall in unison with every other like-sized issue putting the lie to the belief that better than expected earnings are always positive for prices.

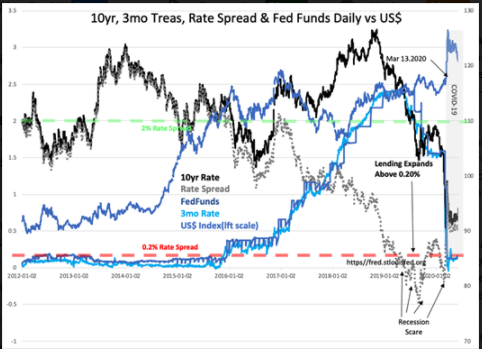

As COVID-19 rolled across the globe, European regulators as they have been prone to do in previous scares, 2008, 2011, 2015, banned short-selling March 13th which is a vital tool hedge funds use to hedge their portfolios from falling prices. The US, being the market without restrictions, received the brunt of European short-selling. The behavior of the US$ vs T-Bill and 10yr Treasury rates tell this story. Like other instances of hedging, it was particularly focused in the leveraged businesses such as REITs, Banking, energy companies, housing and etc. With the US bearing the full force of this activity, US market experienced a record plunge as the US$ spiked with the influx of capital. US T-Bills fell to historic negative rates and the 10yr Treasury reached rate levels never experienced in any market prior. Mega-cap issues did sell down a little but smaller companies experienced 30%-70% declines depending on the algorithmic selling pressure.

The markets began to rebound as soon as it appeared that Initial Jobless Claims had peaked. Being driven by a sudden shift in market psychology, the rebound left many confused that the rebound had no justification in fundamentals which continued to deteriorate. The rebound was primarily due to the few mega-cap Momentum Issues favored by algorithms till after May 18th. May 18th was the day European regulators ended their short-selling ban and some selling pressure in smaller US issues was relieved. In the past 10days the US$ has been weakening as capital shifts back to Europe and elsewhere. This morning, the 10yr Treasury rate rose to 0.8%+ as capital shifts to seek better returns.

The Initial Claims report of this morning reversed today’s early equity decline. This is the impact of data on market psychology. The US$ continues its downward trend as capital shifts back to Europe and other venues. The relief of short-selling of smaller issues in the SP500 is driving the index higher even with the mega-cap FANG or FAANG issues showing some decline today. Market psychology is like that.

There are many who claimed we faced something worse than the Great Depression with the March collapse. Now, they are touting a much faster recovery than expected. It is too early to tell from economic indicators which is true. That recovery is certain lays in the 400yr record of unexpected financial events and subsequent recoveries. Net/net, the answer is that we have always recovered and will do so this time.

The investment advice remains the same. Buy the heavily discounted well-managed companies with high relative insider accumulation. Do not buy the market leaders! Do not buy Fixed Income beyond short-term maturities! The equity market should continue to rise but so should rates as investors come to realize that equities offer the better returns.