While I would not consider myself “bearish” right now, I will say I am concerned. I think a lot of the data we are seeing now is simply “catch-up” activity due to the shutdown. My concern is what happens when Fed aid dries up and people realize the jobs they had are not there to go back to. Q3 and Q4 worry me.

I may be 100% wrong but if I am, I think the companies we own do very well and we still make money. If I am right and we slow down in Q3/4 then we now have plenty of cash after yesterday’s sales to take advantage of that as I think the market overreacts to that on the downside.

Personally I am at the highest cash level in my accounts in over a decade.

“Davidson” submits:

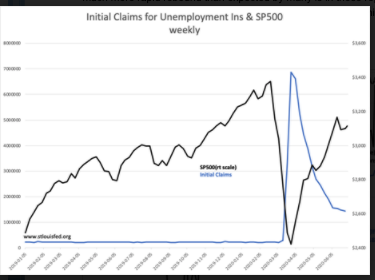

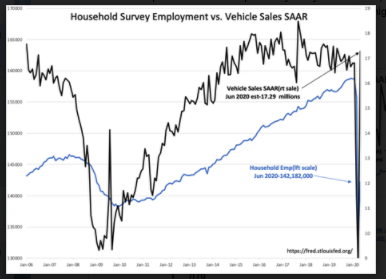

The Household Survey Emp reports a rise of 4,940,000 individuals working and Initial Claims for Unemployment Insurance drifts lower. Vehicle sales estimated SAAR(Seasonally Adjusted Annual Rate) for June rebounds to 17.29mil. Even taking into account that economic indicators do not capture the precise position of the US economy, a much more rapid rebound than expected by many is in these reports. The skeptics continue to dismiss these reports as inconsistent with their personal perceptions. Markets open higher.