I’m not as optimistic about this data as Davidson is. My opinion is most of this is simply inventory restocking and we need to wait a month or so to see where it goes from there. My guess is flat to down a bit….

“Davidson” submits:

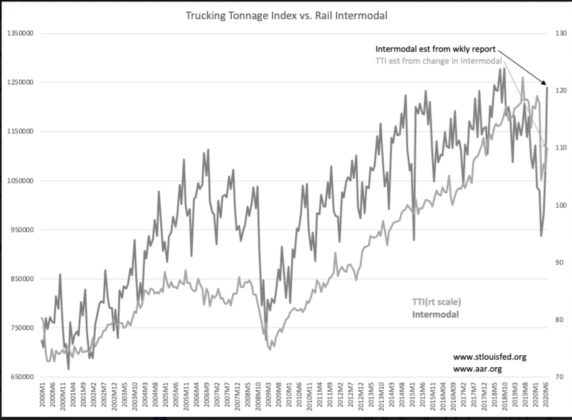

Intermodal Rail Traffic measures the number of railcars used to transport preloaded transportation containers and truck trailers. This traffic has recently exceeded bulk car traffic which is that used to transport commodities on specifically designed cars grain, cement, stone, crude oil, coal and automobiles. As a measure of the pace of economic activity, rail traffic has long been a Warren Buffett favorite. There is a good correlation with the Trucking Tonnage Index(TTI) as one might expect long term. The advantage of rail traffic is that it is reported weekly and provides an early read to the monthly trend before the data is finalized. Despite being volatile, the recent reports indicate that economic activity is in a relatively strong recovery as the US exits the COVID-19 shutdown. The monthly chart Trucking Tonnage Index vs. Rail Intermodal uses the trend in the weekly data to create estimates for both economic measures for the current month. The est-TTI for July is likely underestimated and will be corrected once reported.

Intermodal Rail Traffic is another hard count economic indicator (as opposed to prices which are dependent on market psychology). Current trends provide support for a more rapid economic recovery than many expect. Equity prices and interest rates are likely to be higher in 12mos as investors recognize the economic strength reflected in this data.