“Davidson” submits:

The 10yr Treasury rises to 0.7% from 0.55% lows on Aug 4th. At some point we can expect a rate rise, but predicting it is dependent on predicting changes in market psychology which means we must include differing global market psychologies and foreign geopolitics. Winston Churchill said it best.

“I cannot forecast to you the action of Russia. It is a riddle, wrapped in a mystery, inside an enigma; but perhaps there is a key. That key is Russian national interest.”

Winston Churchill in a speech to Parliament 1939

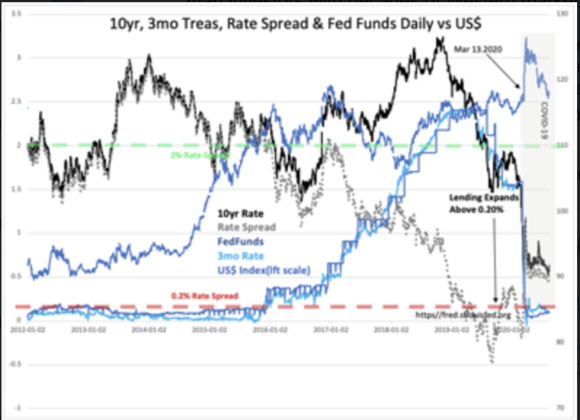

The daily history of the 10yr, 3mo Treasury rates, rate spread(yield curve) Fed Funds and the US$ provides an interesting view since Jan 2012. The sharp rise in the US$ March 13th was due to European regulators banning short selling in response to COVID-19 to protect their equity markets and financial institutions. This ban drove that activity to US markets making demand for US$ assets higher. That demand has abated as the ban was lifted and markets normalized letting the US$ drift back towards pre-COVID-19 levels. Part of the COVID-19 panic included a brief period of negative T-Bill rates and 10yr Treasury rate reaching 0.55%. This period proved to be the low in the 5,000yr history of global rates.

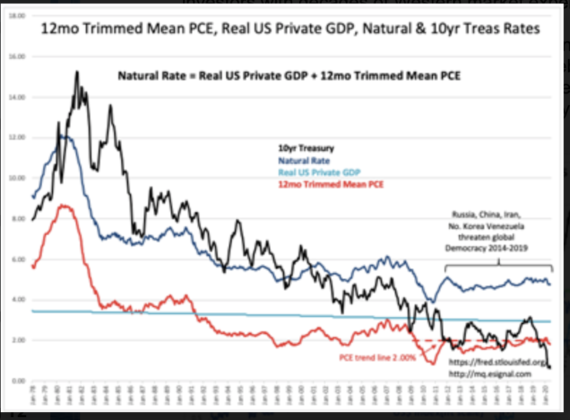

Rates are more likely than not to rise going forward. Forecasting this only has the fact that some history repeats. The history of rates was first identified by Knut Wicksell in 1898 in his “Interest Rates and Prices”. He theorized the concept of the ‘Natural Rate’ which markets tended to adhere over several market cycles. The Natural Rate is the fundamental growth rate of a particular culture. In the US, it is the long-term trend of Real GDP plus 12mo inflation and the current rate is 4.75%.

The Natural Rate is roughly where 10yr Treas rates have priced over time. Rates like every other security are dependent on market psychology. The relationship held up reasonably well from 1979 to the late 1990s. (1979 is the inception of the 12mo Trimmed Mean PCE used for the inflation input of the calculation) 10yr Treas rates began to seriously fall below the Natural Rate as Modern Portfolio Theory drove Western capital into Emerging Markets seeking higher rates of return. The net effect of building a liquid base of assets in which to invest in Emerging Markets was the beginning of a trickle of capital seeking safer haven back to Western markets. There is no Emerging Market with the protections to private property levels present in Western markets. Capital flows continued into the West as autocratic leadership in EmgMkts moved by various means to confiscate portions of this wealth for their own benefit. The net impact eventually drove Sovereign 10yr rates to historic lows (some even negative a couple of years before COVID-19) and real estate prices to record highs as favored investments. Investing into 10yr bonds does not make sense till one recognizes that it makes a lot of sense to EmgMkt investors whose domestic currencies are eroding at a faster rate..

COVID-19 spurred additional global capital transfers to the US. March 13, 2020 saw a 3day surge when European regulators banned short-selling. European capital shifted capital to US markets to do their shorting which drove US markets lower in the fastest decline in history. This pressure eased as European regulators lifted their bans, but investor panic has remained driving rates to 0.55% for the 10yr Treas. Seeing the 10yr Treas rate recover over 0.7% is significant in my opinion. This means rates are more likely than not to rise even more as regain optimism to invest in equities.

The history of the Natural Rate and 10yr Treasury rates suggests a rise towards 4.75% is reasonable. Clearly, the capital inflows for EmgMkts have favored safety over returns in assets these investors preferred. Whether this cycle sees the 10yr Treas reestablish its relationship with the Natural Rate will depend on investor psychology. The rate relationship may not normalize this cycle as EmgMkt investors have a different historical/cultural perspective than investors with decades of Western market experience.

All in, low rates, deregulation, lower taxes and new trade agreements with lower tariffs stimulate economic growth. Many economic indicators show that a sharp rebound from the COVID-19 shutdown is in progress and helped by recent pro-business policies. As investors come to realize that higher returns are more likely in equities, we can expect rates to rise AND equities to rise as they seek these returns.