The flip side to this is that what we are seeing is catchup purchases by consumers and inventory repletion by businesses.

What will be the tell is the level of inventory rebuilding going forward. Do we rebuild it but at much lower levels reflecting the anticipated slowdown in spending? As moratoriums on evictions, foreclosures, and actions on unpaid bills expire, IMO consumer spending is going to fall quickly. I’m of the opinion what we are seeing is simply a snapback in spending due to repressed demand but these levels will fall.

“Davidson” submits:

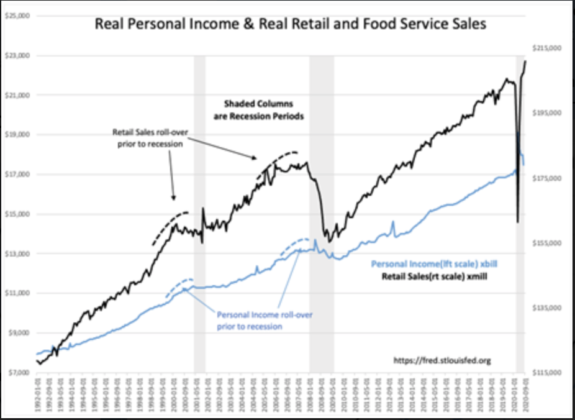

Real Retail Sales reported a historical high while many continue to discuss recession. This spike is likely to be revised in future reports but the trend from 2009 as the trend from 2009 remains intact. This month’s report stands impressive as a single data point. Many investors fail to absorb the fundamental strength of the current economy based on multiple government policy initiatives of regulation reduction, tax reduction, economic opportunity zones, tariff reduction, lower healthcare costs and etc.

Policy matters! Policy can favor or hinder economic growth. This is especially important for recovery when unexpected shocks such as the COVID-19 shutdown. Few recognized the 1mil drop week-over-week in Continued Unemployment claims reported yesterday and instead focused on the minor rise in new claims as more meaningful. The importance of the Continued Claims trend far exceeds that of Initial Claims.

Adding to Retail Sales is the record low Aug 2020 Total Inv-to-Sales ratio. Inventories which remain exceedingly low relative to sales. A certain level of inventory is always required to run an efficient goods-to-consumer pipeline. Employment will have to rise to rebuild needed inventories with associated improvements in Personal Income and Retail Sales for rehired employees.

It has been a period of painful grudging acceptance that economic activity continues to improve faster than most forecast. Data continues to support expectations that future improvements will deliver us back to the pre-COVID-19 economic pace in short order.

Investors are advised to add capital to portfolios in anticipation that the current level of pessimism shifts towards optimism and higher equity prices the next few years.