A common theme is that the “Robinhood trader” is driving the market higher….but is it true?

“Davidson” submits:

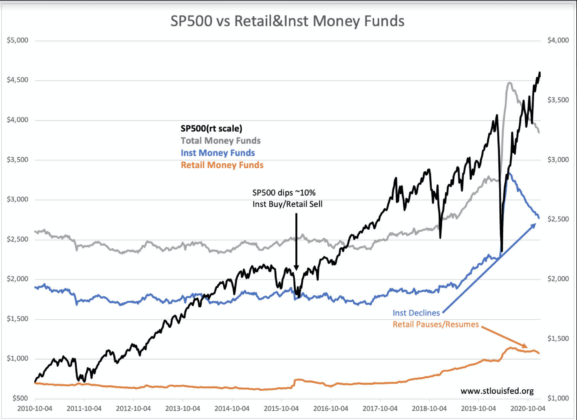

Institutional Money Funds correlate more strongly with SP500 than Retail Funds since 2016. The weekly data shows that early 2016 the SP500 dipped ~10%. The response from Institutions was to buy equities as shown by the dip in Inst Money Funds while Retail Investors sold causing Retail Money Funds to rise. Since then, then minor declines in SP500 show rises in Retail Money Funds while Institutional Money Funds decline.

The COVID-19 lockdown reversed this pattern. In March 2020 as the SP500 fell both investor groups sold equities with Institutional Money Funds rising a larger percentage than Retail. Multiple recession forecasts beginning 2018 saw Institutions increase cash by 74% through May 2020 vs a much smaller rise of 29% by Retail Investors. As the SP500 began to rise from the March lows, cash into Money Funds peaked in May 2020. Since then, Institutions have steadily added to equities. Retail Investors gradually added to equities but paused prior to the Presidential Election and then resumed adding to equities thereafter. While some equity volatility occurred around the election, markets continued higher as Institutional Money Funds declined.