The US market is not “cheap” by any means……..

“Davidson” submits:

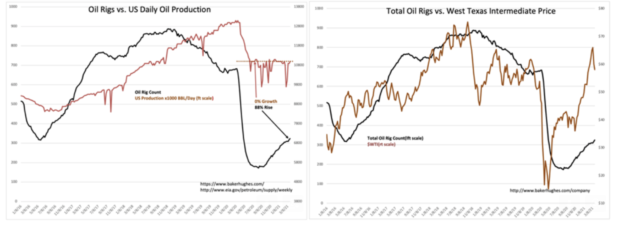

The Baker Hughes GE Rig Count reports 6 more oil rigs working vs the prior week. This is an increase of 88%+ from the Aug 2020 lows. US crude production remains 11mil BBL/Day level as it has roughly been since Jun 2020. $WTI slipped from $66/BBL to $58/BBL last week in a bout of algorithmic hedging but sit closer to $61/BBL today.

If we see a continued rise in the rig count next week, then it may be safe to assume that $WTI above $60/BBL is a trigger for E&P companies to expand drilling who had expressed caution till “better times” justified.

US energy markets remain in an undersupplied condition and $WTI should rise with economic expansion.

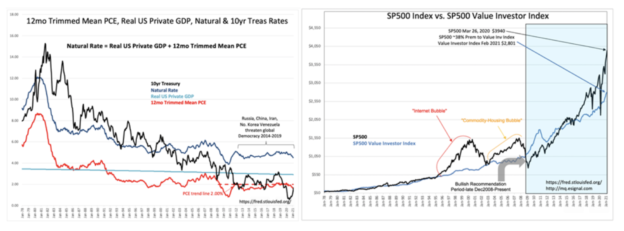

The 12mo Trimmed Mean PCE was reported at a 4mo low of 1.6%. Many pundits have red flagged inflation pressures but little is showing in this report. It is important to note that rises in inflation in my opinion follow increased regulation and government spending. The inflation numbers we see currently are from the last administration with added regs and govt spending of the current administration yet to have impact. The SP500 has a 38% premium to the Value Investor Index. A 65% premium is associated with high levels of investor speculation.

The US 10yr Treasury rate of 1.67% is well below what in my opinion is the historical Natural Rate of 4.6%. I attribute rates below the Natural Rate as due to global capital seeking safe haven especially as EmgMkts IPO new companies and newly liquid business owners transfer capital to Western nations. Some of the Bitcoin and “NFT” investing which has been the recent rage comes from these inexperienced investors in my opinion.