“Davidson” submits:

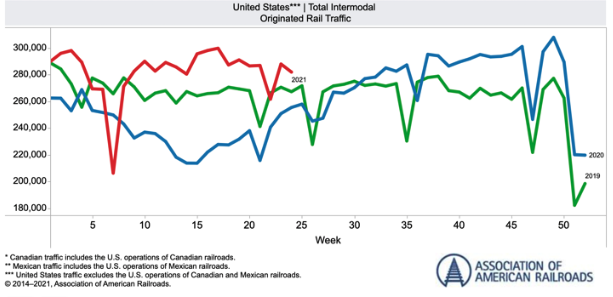

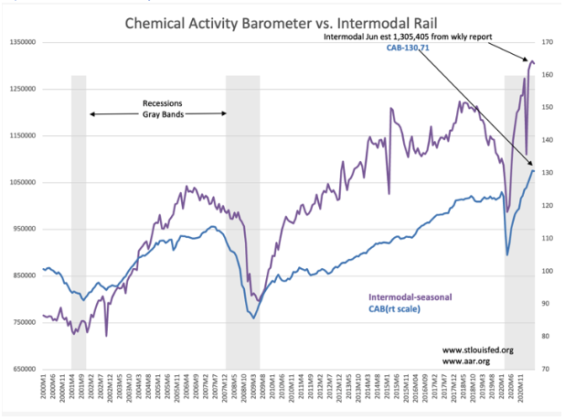

The Chemical Activity Barometer(CAB) and Intermodal Rail traffic indicators continue higher. The CAB reflects a wide range of economic demand in manufacturing for industry and retail sectors and Intermodal represents the demand for transport of goods. Both indicators continue to post improved levels. Earlier reports in the CAB were revised higher this month.

While not in lockstep with each other(some would argue they are indeed in lockstep), they tend to be strongly coincident with each other. Past turns higher have proved to signal the end of recession periods. What is surprising is that NBER, the official agency in defining recession periods, has not commented on the obvious turn higher in both CAB and Intermodal April 2020. Many continue to believe that the US economy remains in recession when it should be obvious the US exited more than 12mos ago.

There remain several $Trillion on the investment sidelines. It hard not to expect some of this capital will enter equity markets if NBER declares a recession end. The recommendation continues to be fully invested in equities and to avoid longer-dated fixed income. As the economic cycle progresses, interest rates should rise as investors shift capital out of fixed income to higher perceived returns in equities as confidence builds.