“Davidson” submits:

Turn on your critical listening and thinking skills to media reporting on financial markets. It should not take more than 5min to hear some speaker or host asking or declaring, “The market says…”. Commentary with this language is the basis for 95%+ of reporting in my estimation. Taking investment cues from market price-trends is pure Momentum Investing. Price-trend investors announce their position with certainty with charts to back their assertions. Once the price-trend has set the definitive perspective, some tie their advice to fundamental indicators as underlying support. Fundamentals do indeed determine the price-trends over longer-periods, but not within the time frame presented by media pundits. The media is reporting on shifts of market psychology day-to-day, with single events, if deemed significant enough. They shift their entire perspective from one of optimism to pessimism or vice versa within minutes. “Turning on a dime!” has always been apt. Why the media favors reporting such rapid shifts has a simple explanation. Advisor flip-flops are highly entertaining and provides the moment-to-moment drama required to draw viewership driving advertising revenue. Fear of loss(risk) is the main driver in the human psyche. This has long been behind the media’s selection of which stories to highlight. This is the reason Momentum Investors receive such coverage. If one listens to Momentum Investors, one will churn one’s portfolio with fees and be sadly disappointed with the outcome.

Today, to achieve successful investment outcomes, one needs to follow the increasingly less-traveled guidance of fundamentals. This means one must identify information seldom discussed. One must draw inferences and make interpretations one may never hear in the media’s price-trend focus. Fundamental analysis is the bailiwick of Value Investors. Because economic and business fundamentals do not change much quarter-to-quarter or even experience relevant trend shifts year-over-year, they do not generate much news activity. Economic trends reported monthly have past reports routinely revised with little attention paid to whether revisions were higher or lower. Much of the importance of the long-term economic trend is lost as short-term traders apply 12mo compounding to any monthly-mismatch vs expectations as if it is predictive. That there is little credibility in these predictions when the next data revision negates their basis.

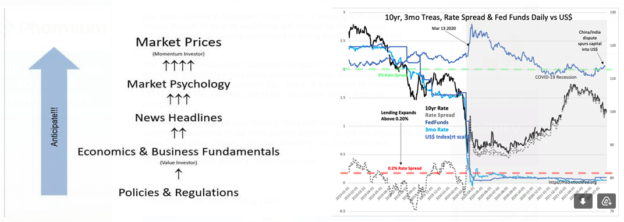

The graphic indicates how market prices are determined through the a filter of time delays, reporting, perception and eventual emergence into market psychology. Momentum investors, who believe themselves to be the first to know, are last not first in the chain of information. By the time a price-trend has formed, fundamental trends have been well in place sometimes for several years. Consider the very recent declaration that the COVID Recession ended April 2020. Multiple fundamental indicators turned higher April 2020 signaling recession’s end. The media has yet to catch up. Much of the commentary continues to a state of ‘disappointment’ still requiring added government stimulus. We are so far past needing stimulation that anything new now threatens massive inflation. Note in the graphic that Value Investing is based 4 layers below Market Prices. Information on which value decisions are based comes from slowly moving economic trends providing positive/negative signals with some stretching over decades in the form of government policies while others represent the few years of the economic cycle. Value Investing requires patience. The Momentum Investor and media cycle can “Turn on a dime!” while economic cycles only shift direction over years.

When one is investing long-term one must look through the fog of opinion of short-term trading to sort out the most relevant information. The fall of Afghanistan is a piece of short-term news to which short-term traders respond by selling stocks and shorting oil to hedge portfolios. While the world has changed for the moment short-term, long-term liquidity remains and recovery out of the COVID Recession continues regardless of government policy errors. Some believe this time is different. History shows that all markets are different. Government nearly always makes erroneous decisions to which the population adjusts and negotiates to continue economic growth.

The net/net end of every economic cycle since 1953 has been yield curve inversion not a geopolitical event or government edict. The relationship of the T-Bill to the 10yr Treasury rate has been the best single indicator in every cycle. Understanding this requires interpreting what is shown differently than what is commonly accepted. The accepted view is that an inverted yield curve i.e., short-term rates exceeding long-term rates, signals economic tops regardless of whether it is the 10yr rate falling or the T-Bill rate rising. This interpretation ignores the flood of capital, a relatively recent trend, from foreign investors supplying continued liquidity to markets which pushes 10yr rates lower. The better interpretation of rate history is that rising/falling rates reflect market psychology of investors seeking to manage risk/return. The current pressure on 10yr rates has been with us for more than 10yrs as the financial systems globalized and EmgMkt investors sought safe havens in Western markets to protect personal assets from confiscatory governments. This has forced some Sovereign debt rates negative as their issuance was too small to accept this flood of capital. Negative rates were not enough to stop the capital shifts as currency exchange rates still netted positive returns. Falling 10yr rates as a result did not equal weakness in these countries even though most Central Bankers have made this interpretation based on long followed price-trends. They have not and still have not recognized that the global currency-flow-impact on bond prices reflects unstable government offshore not economic weakness at home. The policies by Central Bankers to add liquidity in response is erroneous interpretation.

The better interpretation to yield curve inversion is to think of rates reflecting investor psychology. As long as short-term rates remain low, investors and businesses are keeping a reserve of capital to meet unexpected conditions. Reserve capital permits companies and investors to withstand short-term market psychology shifts without wholesale retrenchments. It is when all have become overly optimistic that reserves are committed to achieve higher returns and short-term rates rise to invert the yield curve. At this point, without reserves, retrenchment is the only response to unexpected negatives and the business cycle tops followed by a top in the investment cycle.

In other words, an inverted yield curve from falling 10yr rates, even though Central Bankers fear this, is not the signal of overly speculative market behavior that leads to major corrections. It is when over-confidence drives T-Bill rates higher, exceeding 10yr Treasury rates, that eventually traps investors into illiquid positions which leads to significant corrections. Afghanistan is not this. The T-Bill/10yr Treasury rate spread remains well above 0.2% historical signal of any recession in a long history of recessionary signals. While Afghanistan is very messy, it does not represent a market top just as many such events in the past did not.