All the data continues to point to the same eventuality. We will run up against capacity restraints on the US pipeline network in the coming years. With bans in place both at the state national levels, there will be no more large-scale pipeline projects built in the US for at least the next 3-5 years. With demand for oil and gas continuing to climb, there simply will not be enough capacity to move all that is necessary as we are already seeing capacity at some places at 90%. KMI and WMB, with the largest US footprints, will be the primary beneficiaries as this unfolds.

“Davidson” submits:

LNG has risen to 51% of US Natural Gas Exports. The current pace has stalled from a torrid 70% in place pre-COVID. Exports by pipeline have been growing 7% and continue. There is a price spike reported by EIA Feb 2021 pipeline prices to Mexico due to the Texas polar vortex that month. A unique regional event not repeated elsewhere.

What is important in this data is the LNG export trend representing global demand for cleaner and less costly energy sources. US is a leading global supplier of LNG and LNG production/transport and power generation technology with reportedly ample supplies of natural gas to continue to remain so.

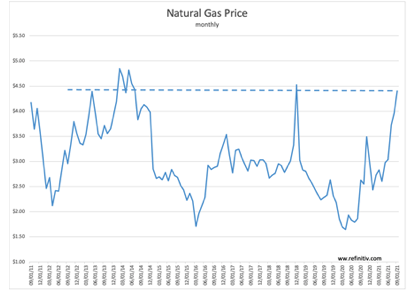

Natural gas prices have risen from $1.50 Apr 2020 during the COVID Recession to today’s pricing $4.70 implying higher demand that is not reflected in actual shipment volumes. Like oil, natural gas has cash and futures markets. In my estimate, current pricing represents speculation not actual demand. Nonetheless, with the oil price spike 2010-2014 to well over $100/BBL in mind, speculation can hold prices higher than one may expect from the actual supply/demand balance. In other words, supply/demand does not at the moment seem out of balance even with a low Baker Hughes gas rig count. But, markets always reflect investor psychology not necessarily reality.