“Davidson” submits:

To the man with a hammer, all looks like a nail. To the blind men with an elephant, each has a different view and, without weighting each view in light of the others, each confidently believes his own interpretation correct. Charlie Munger’s speech June 1995 on bias incentivized to sound correct despite not having all the facts is the classic failure with developing correct market perception. Influencing others has become more important for one’s temporary success than being factual. His favorite book on the subject is by Robert Cialdini, “Influence: The Psychology of Persuasion”, 1993. Youtube carries the full speech:: The belief in mathematical solutions to persuade others of your expertise has its roots in the 1940s when Isaac Asimov wrote what became “The Foundation”, 1951. He reflected the belief at the time which included Robert McNamara’s Whiz Kids that mathematical analysis in the emerging age of computers would elucidate all the secrets of investing and managing businesses. They did not. Businesses and governments still operate through human beings and do not follow mathematical models. It seems that few seem to recognize these models as virtually useless predictors of markets and business outcomes.

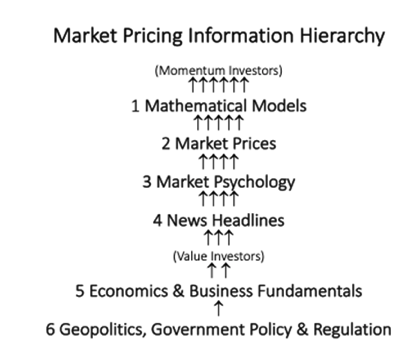

Munger quotes George Bernard Shaw’s 1906 play “The Doctor’s Dilemma”. “Conspiracies against the laity”, referring to the manipulative methods used by professions to acquire prestige, power and wealth.by influencing others to do what is good for themselves. In this vein, mathematics in the hands of some has come to dominate market perception. The Market Pricing Information Hierarchy is updated to include Mathematical Models in the #1 position as the primary source for investment decisions of Momentum Investors. How one sorts through fact vs misperception requires hindsight. Identification of misperception requires asking:

- “What did they say or predict?

- followed by…

- “What factually occurred?”

People seeking to maximize returns over the short-term utilize margin(borrowed capital) and are forced into acting on price-trends In addition, they are forced into using computer driven algorithms to protect capital when trends suddenly do not go as expected precisely because humans cannot react as quickly as computers. Volatility anyone? One of the hedges they use is to short $WTI futures believing the long held view that:

falling equity prices = economic weakness = falling oil consumption

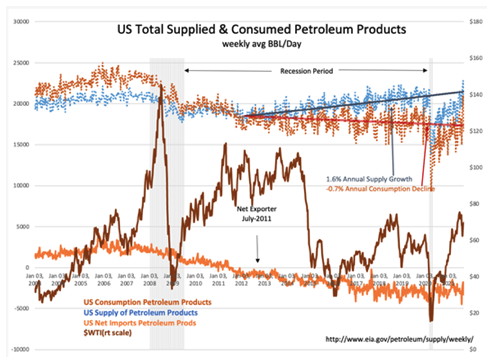

The EIA history US Total Supplied Consumed Petroleum Products reveals that indeed some fall off in consumption occurs during recession periods. But, the longer term trend lines indicate the nature of energy sources is such that is not an excessive drop precisely because energy remains vital to economic activity even during recessions to transport vital goods, operate public transport, heat homes, generate electricity and etc. Unless of course, it was an event like COVID which was an economic lockdown for a period resulting in a period of more supply than demand which has now normalized. The wild fluctuations in $WTI have had more to do with the belief that prices reflect supply/demand daily than the actual supply/demand. The 2008 spike in prices correlates to the period of “Peak Oil” mania when $WTI use was falling. At the time few noticed the many references to corporations implementing “Lean” solutions to make upwards of 50% reductions in energy usage over time, cut manufacturing footprints by 40%+ for the same output and otherwise lower the use of input costs including better quality control to control waste. Ford and Caterpillar were a few of the major corporations who made such announcements in 2005. That did result in a continuous decline is US consumption with energy savings from “Lean” even as GDP grew 3% annually.

The price of $WTI has varied widely on headlines declaring huge imbalances of supply/demand but as the trend lines in consumption patterns reveal, for all that was declared certain by traders, in the final analysis, taking into account seasonal volatility, consumption was on a steady trend even with severe price swings. If anything, consumption was spurred lower by higher prices as companies worked to lower input costs. The $WTI volatility was due to Momentum Investors tracking price trends making economic assumptions which were not supported by fundamental economic data. Much of today’s economic forecasting comes from market driven price-trends when it should be based on underlying fundamentals. This is why Momentum Investors decisions are placed above level 1 (Mathematical Models) while those of Value Investors are placed above levels 5-6. Value Investors must be well-prepared to exercise one of their most precious tools, Patience!

What is witnessed today is that every short-term dip in market confidence triggered by a weakening equity price-trend or falling rates results in a selloff in $WTI as an economic and price hedge. Mind you, this is today’s climate of perception. Should inflation become more of a worry, then the value of oil will shift towards it being an inflation hedge and price will rise, perhaps to new historical highs boosted by higher interest rates and rising industrial equity prices.