“Davidson” submits:

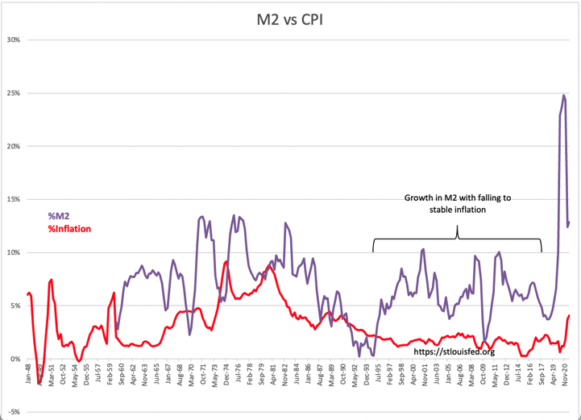

Government policy matters more for inflation than the simple interpretation of more money chasing goods. Milton Friedman said “…inflation is a monetary phenomenon”. Friedman’s observation has become embedded as economic gospel with the inflation of the 1970’s following the prolific government spending of the period on The Great Society, the Vietnam War and the Man on the Moon programs. The data does not support a simple correlation. Two charts, one correlating US GDP…M2 & Core Inflation and one correlating the annual percentage in M2 vs CPI for data. Not only is there no clear correlation with rises in M2 in the 1960s leading to inflation in the 1970s, the period of rising M2 1993-2019 is a period of falling and low inflation without any correlation. Rethinking this relationship is required.

From the Hoover Institution: https://www.hoover.org/research/inflation-true-and-false

“Inflation is always and everywhere a monetary phenomenon.” Monetary economist Milton Friedman made this line famous after stating it in a talk he gave in India in 1963. In a trivial sense, of course, the statement is true. Inflation, by definition, means that money loses its purchasing power and, therefore, is a monetary phenomenon. But Friedman meant much more. After having defined inflation, in that same talk, as a “steady and sustained rise in prices,” Friedman argued that one could not find inflation anywhere in the world that was not caused by a prior increase in the supply of money or in the growth rate of the supply of money. His statement was an empirical one, not a logically necessary one, and most professional economists, still in the thrall of John Maynard Keynes, did not agree with Friedman. But within a decade, the evidence from the United States and other countries had convinced most economists that Friedman was right.

M2 reflects monetary expansion from all sources of which there are only two i.e., government for government programs and banking when expands commercial lending during economic expansion. The former is inflationary while the latter is deflationary. Creation of debt either government debt or corporate debt creates currency i.e., expands available currency, not previously available. Successful corporations pay back debt from profitable operations. A useful approach to understanding this concept is to focus on bank lending and the need for profitable companies paying back debt. The act of paying back debt swaps equity for debt. Being successful means that the company’s offerings must bring value to consumers who have access to many competitive offerings. Consumer always seek to add value to their standard of living which favors those offerings that are of better value in being cheaper, faster or more versatile/innovative i.e., consumer spending is deflationary.

A good example of consumer thirst for innovation is Apple’s introduction of the iPhone in 2007 which had such a favorable impact on consumers that revenue grew 45% annually through one of the deepest recessions in the US economy. Smart phones continue to sell well as they continue to provide innovations which improve standards of living. As successful corporations repay their debt, the temporary currency expansion first created on the issuance of debt is converted to permanent currency. Profitable companies expand GDP. If a company is not profitable, it defaults on its debt and lenders must write off the loan. The loss to the lender is also a reduction of currency outstanding. Profitable/innovative companies expand GDP and are deflationary. In a competitive world, they are always providing more value with fewer resources or they would not survive.

Government lending, because default does not occur, is always a permanent addition to currency. If government spending does not add value to citizen’s standard of living, it does not add to long term GDP. The reality is that government spending is always inflationary. Some spending is particularly inflationary as during periods in which little competition occurs and little value is added to GDP relative to currency issued. Wars are a primary source of inflation. Government spending is often directed based on political considerations.

With M2, it matters why it is expanding and whether the currency expansion represents profitable additions to GDP or unprofitable and wasteful allocations with other purposes. The current expansion in M2 initially did not appear to have an inflation impact. Most of this expansion occurred due to transfer payments to distressed citizens and businesses as a result of the COVID shutdown. The spending decisions were mostly in control of individuals seeking the best values they could identify. With the change of administration, inflation has turned dramatically higher. The spending is now more controlled by government than by individuals. A policy change has occurred. Precisely which policies or changes in government actions are responsible remain to be determined only in hindsight as this story evolves. What is clear is that a dramatic change has occurred with many assumptions but few connections to specific causality.

The long-held M2 connection with inflation requires reappraisal.