It is simply amazing how fast the media can turn from “peak oil”, to “permanent glut” to “peak oil ” again. It seems we are back to peak oil talk. We’ve been calling for $100 oil here for some time and it is getting there ($92 today). However, the reason is NOT “peak oil”, it is misguided federal energy policies that have drillers and the industry hesitant to expand for fears of the rules changing on a whim. We’ve already had drilling and exploration bans that have been partially reversed then maybe not, and then, maybe yes again. There is too much capital required for the industry to commit billions to exploration and drilling to have a policy that seems to change nearly monthly. When we get this dynamic, the industry simply sits back and waits for a clear policy. This is what is happening now. Price will have nowhere to go but up barring a recession.

“Davidson” submits:

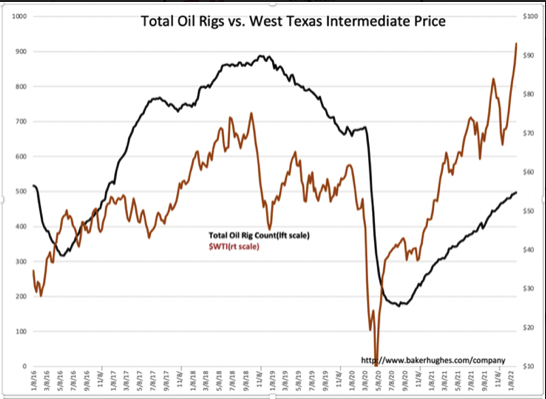

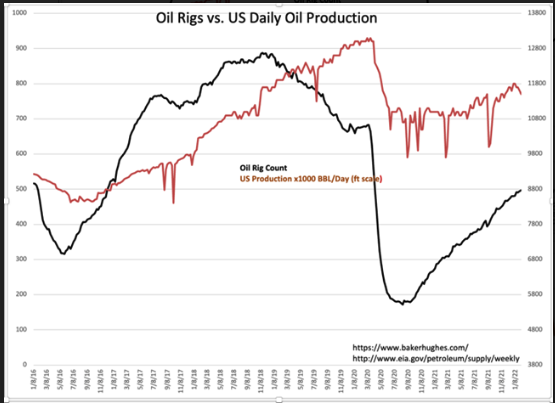

Baker Hughes Rig Count is reported higher by 3, 2 oil rigs and 1 gas rig. Higher oil prices and lower production indicate a disciplined CAPEX expenditure independent of near term market conditions. Yesterday, the WSJ published “Oil Frackers Brace for End of U.S. Shale Boom”. None of the companies believe this viewpoint credible. It reminds one of the “Peak Oil” scare 2007-2009 beginning once again. There have been prior similar predictions which proved false as innovations led to utilization of geology not previously accessible. In my estimation, this article is in part responsible for some of the recent gains in $WTI, now at $93/BBL.

Oil Frackers Brace for End of the U.S. Shale Boom

Limited inventory leaves the industry with little choice but to hold back growth, even amid high oil prices

https://www.wsj.com/articles/fracking-oil-prices-shale-boom-11643824329

The US Oil Situation remains undersupplied with current needs supplied by inventory reductions and imports. Foreign producers are under-producing their targets by significant levels. Some observers indicate they are unable to produce more on demand. Clearly 7yrs of under-investment has left the industry without sufficient skilled labor or equipment and the current supply chain issues have pushed production of new equipment perhaps 12mos-18mos more distant.

Conditions are building for much higher oil prices. US employment continues to recover. Europe and the rest of the world are behind the US but normalizing. The is the type of environment where stories like that in the WSJ and sharpen the trajectory higher.