I do not think we are at a “peak oil” scenario. What I do think is we have a constantly shifting energy and drilling policy in the US now and that simply does not work for the long-term planning needed for the industry to make significant investments. Until the energy industry feels safe in starting multi-million dollar projects, they need to have some level of confidence those projects are not going to be scrapped on a whim from Washington, thus stranding millions in then lost investment.

Until we get that, we can expect energy prices to continue their upward march. The unfortunate thing about this is the dynamic will be in place for some time. Even if we played “what if” and said the US formulates a long-term plan next month, it takes time for the industry to then decided what to do within those parameters and then implement it. In short, the current state of the energy market will have a decent, long-tail effect into the future that is negative for consumers.

“Davidson” submits:

-

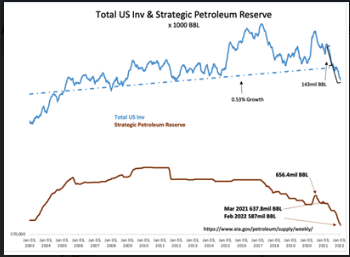

US Crude Prod 11.6mil BBL/Day(0.1mil higher vs last week), US Crude Imports 3.3mil BBL/Day(1.3mil lower vs last week) Total US Crude Inv fall 6.2mil BBL(4.8mil working Inv and 1.4mil SPR)

-

US Gas Inv lower by 1.7mil BBL, Crude Refining Input rise 0.3mil BBL/Day, US Exports Refined Prod remain low, Jet Fuel consumption remains at lower levels, US Consumption appears reaching for higher level

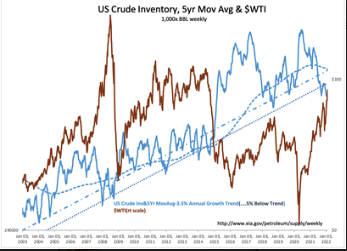

The overall picture in the US Oil Situation is continued production discipline as crude inventories continue in decline. US Gasoline Inventories are lower on during refinery shutdowns for maintenance with available domestic supplies being supplemented by lower exports. US Consumption in recent weeks appears to be reaching higher levels. The volatility in data makes this too early to call.

Since March 2021, Total US Crude Inv has fallen 143mil BBL or ~13%. ~70 mil BBL of this decline is in the SPR while the rest comes from the industry working inventory which with this report hit a new low vs trend-line from 2003.

A few analysts see a crude deficit and forecast much higher prices, yet market activity reflects disbelief.