Property rights are a real thing absent in many nations. Without them, you never really own anything and it can be taken away in a second. US residents and companies are losing $100’sB of dollars in cash and assets in Russia that are simply gone now.

“Davidson” submits:

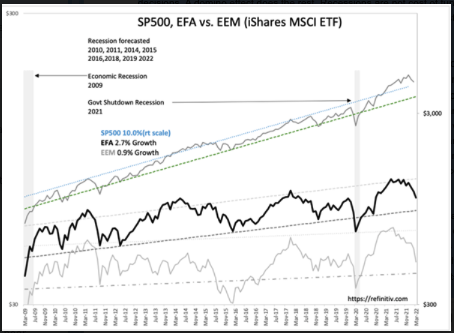

Current geopolitics reinforce the assertion that investing only in US is the only option investors should consider. Furthermore, the many recent forecasts for recession, including significant investment firms, are without support. The issues in China, Russia, Iran, Turkey, Venezuela, issues in African countries and etc., which are all Emerging Market countries, have been apparent for decades. While it may appear each has unique problems, the underlying difference between the US and any other country is the degree individual property rights have protection from government confiscation. The political systems of every other country range from socialist to autocratic/dictatorial. The freedom to innovate and advance one’s standard of living by developing ideas into products that benefit society is the basis of the US Constitution. No other country has supported innovation and entrepreneurs protecting individual property rights from state actors better than in the US. No better visual to demonstrate how beneficial this is vs any other form of self-governance is SP500, EFA vs. EEM.

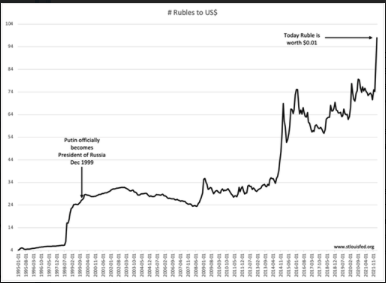

A good recent example of leadership destroying its citizens’ standard of living is # Rubles to US$. The same has occurred in Turkey, Venezuela, Iran, Cuba, Argentina and a long list of failed economies where government have failed their citizens. The destruction is identical as the source is identical i.e., top-down political control designed to keep one group in power. Yet, advice by many from the best business institutions in the US and globally ignore this impact and claim investors should, even today, invest 40% of capital because these markets “are cheap”. The misperception, which is an enormous miss in my opinion, is believing that a mathematical comparison between US and other countries on financial metrics such as Pr/Earnings, Pr/Cash Flow and etc. captures all one needs to know. SP500, EFA vs. EEMclearly shows this perception does not fit the reality. The basis for market success is not found in a mathematical representation as has been the focus of Nobel Prizes and institutional teachings for 70yrs+. The answer to understanding markets comes from understanding people and value enshrined in the US Constitution, namely Amendments 1-5. Amendments 1-5 are a secular expression of the “Golden Rule” i.e., the long repeated ‘treat others as you want yourself to be treated’. The rule of reciprocity is the basis of markets and human survival through formation of societies acting in concert. The process occurs on an individually controlled level that Adam Smith referred to as the “invisible hand”. China, Russia and the rest were never investible. Those who say these countries are no longer investible miss the most fundamental of fundamentals. Without individual property rights, nothing is investible!

Reciprocity is a focus on I win/you win outcomes. Cooperative transactions result in 1 +1 = 3 economic outcomes. It is how economic growth seemingly out of nothing but innovations, shared for mutual benefit in market-based behavior, creates significant advances in standards of living and economic expansion. The US has been unique creating a body of law protecting individual property rights including free speech, self-defense and exploitation of one’s own innovation within the concept of the Golden Rule. In my study, the Golden Rule is DNA-based behavior. Just as birds do not have to be taught to build specifically shaped nests to assure their survival, a behavior certainly dictated by DNA, human genetics direct win/win cooperative interactions within groups to assure that specific talents are distributed through exchanges of output to ensure group survival. This is not compelled behavior from top-down authoritarian leadership, but self-directed bottom-up activity by individuals retaining autonomy of action for the common good. The long established study of economics and businesses the last 70yr+ using mathematics to elucidate the secret nature of how it all truly works ignores this human activity. Economics ignores the importance of Amendments 1-5. My perspective is non-traditional and it explains everything that confuses traditional training.

My focus on individual behavior is the basis for the focus on management skill levels and ‘Lean Management” approaches which result in spectacular differences in corporate outcomes. Corporate outcomes are predicted not to mathematical precision, but predicted within a range of possibilities. It is why one can buy deeply depressed shares vs management’s financial record without being able to perfectly predict the future. You buy shares of companies with good management teams during periods of distress simply because the evidence of past successes indicates they know how to work through unexpected challenges.

Skilled management has clear identifiers:

- They do what they say. They take appropriate corrective action when necessary.

- They are exceptionally in tune with both top-down themes and bottom-up details.

- They always speak the truth. The people around them speak the truth.

You can clearly hear tonal differences between people who are glib, avoiding being pinned-down and skirting issues vs. those who are straightforward with potential outcomes and issues. It takes only a few individual corporate reviews in the latter group to provide economic and market insights better than any economist. It quickly becomes clear that the analytical focus on predicting product outcomes and math-based short-term earnings forecasts miss entirely the concept that management’s responses to market forces make such forecasts of earnings and share prices often to pennies-per-share more magical thinking than anything else. Add to this mix algorithmic trading, geopolitics and subsequent major market predictions roiling prices and one leans away from attributing any value to what any ‘expert’ says. Despite this confusion one can still invest if one steps back a few paces, views markets longer-term and brings into consideration how prices are driven by market psychology which are in turn driven by headlines which are in turn driven by business outcomes that have been driven by skilled management working within a pool of often misguided government policies. At first it appears an unfathomable puzzle. It turns out, this is not the case when the focus is on management.

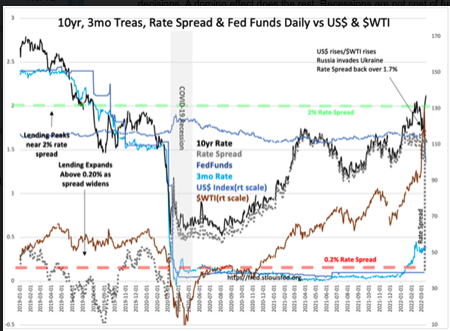

With a focus on management skills at individual companies, the detailed spreadsheet and product analyses which occupy an enormous effort are no longer needed. Investment decisions come down to simple considerations. If the management is skilled, then trust them to make every going to market considerations i.e., how to develop and produce products, which products to offer and how to market. They have a record of doing this. Simply make sure the same skill set is in place. The goal is to buy shares at the greatest discount to management’s record when the general context is positive for a favorable outcome. This brings us to the many current calls for recession due to geopolitical turmoil, the Fed’s actions, high-tech stocks topping or other events too numerous to detail. Just as most using mathematical approaches miss the basics of human behavior for EmgMkts and individual securities, they also rely on the same and headlines to infer economic and market tops. The better approach in my experience is to pay close attention to the T-Bill/10yr Treasury Rate Spread.

T-Bill/10yr Treasury Rate Spread has a long history the importance of which is mostly ignored by those who focus in the ‘cost of funds’ concept. The cost of funds concept believes rates rise to a level making borrowing costs too expensive for companies and economies to grow. Even when rates were 18% in the early 1980s US, we exited back-to-back recessions making cost-of-funds inoperable, yet this concept remains consensus thinking. Rethinking rates as reflecting investor behavior regarding investment opportunities vs remaining in the safety of fixed income provides the correct perspective. Investors shift capital seeking the better risk/return opportunities throughout every market cycle. They buy fixed income when equites appear to have poorer relative returns and sell fixed income when equities appear to have better relative returns. Every investor makes their own decisions which results in rates reflecting market psychology with longest maturities having the highest rates. It is called the Yield Curve. T-Bills being the safest, most liquid investment in the marketplace, serve as such a repository.

The T-Bill rate in relationship to the 10yr Treasury is an excellent indicator of market psychology and the ability to withstand unexpected market stresses. Every recession begins with a negative event that scares enough investors at a time when the T-Bill rate has risen to within 0.2% of 10yr treasury rate. In a normal investor driven market cycle, 0.2% represents the condition of investors shifting virtually all their capital out of the safety of T-Bills and into perceived and longer-dated relatively illiquid investment opportunities. 0.2% T-Bill/10yr Treasury Rate Spread represents the extreme of investor speculation. Many believe they cannot lose and therefore have no need for back-up capital. It may also represent the opinion that T-Bill rates cannot possibly keep up with the risk of inflation and therefore one must own investments that counter inflation.

Investor, lender and business psychology reverse very quickly when geopolitical negatives catch them overly committed to longer-term positions which often includes margin. Increasing liquidity in cautious response by many at the same time results in price declines that panics many into selling at any price. The sudden shift lower stalls lending and business decisions. A domino effect does the rest. Recessions are not cost of funds events, they result from the rapid shift to market pessimism by investors overly committed to illiquid positions just days before. Recessions are liquidity driven events with a trigger.

Markets look scary with all that is occurring today. The spikes in commodities, plunges in currencies and share prices each has a story by some analyst declaring it sign of imminent recession. Many indicate we have never such conditions. The truth is, markets never repeat with same top-down conditions. But there is a truth in T-Bill/10yr Treasury Rate Spread that has held the test of time. Markets are driven by market psychology and that can be measured. The T-Bill/10yr Treasury Rate Spread has been rising since we exited recession April 2020. Today, even with the volume of negative news, the rate spread has widened to 1.7%. Markets rise as rates reflect investor shifts towards equities and today’s investors are shifting more capital to equities. The rising spread also improves lending profits for lenders and they expand lending. To those who believe markets are a confidence game, they have the word correct but not the meaning. Markets cycle with the rise and fall in confidence.

Every market has multiple themes. Today’s market themes are shifting away from COVID-stay-at-home speculations back towards routine core economic themed companies. In other words, out of Zoom, Docusign, Tesla, Apple, TeleDoc and a host of others represented by ARKK’s portfolio. With volatility, investors are moving back towards Boeing, Exxon Mobil, auto-parts, construction companies and the essential companies underlying core economics growth as the world continues to exit COVID. The T-Bill/10yr Treasury Rate Spread suggests higher equity markets for next 3yrs-5yrs.