Oil has fallen from the highs and settled ~$110/bbl. Many think the worst is behind us here but as the global economy recovers, we think the current supply will prove to be woefully inadequate. Do not be surprised to see gas prices start to rise as air travel, as well as the summer driving season kick into high gear in the next few months.

This of course assumes no deterioration in the Russia/Ukraine situation.

Commentary by Diamondback’s Pr Van’t Hof:

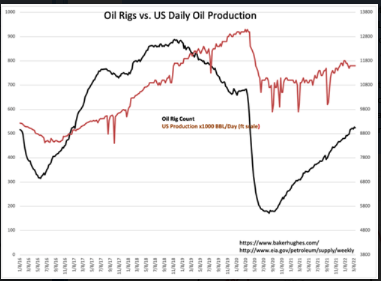

“The industry has now worked off all of the voluntary DUCs,” said Diamondback President Kaes Van’t Hof, referring to wells companies intentionally left dormant.”

https://www.wsj.com/articles/shale-companies-drilling-more-but-oil-output-growing-little-11647855002

This means the general assumption many have all these DUC (drilled but uncompleted) wells we can just plug into a begin pumping oil quickly is simply false. It’s going to take time to bring more supply to the market.

The biggest risk given this is significantly higher prices over the coming months vs lower.

“Davidson” submits:

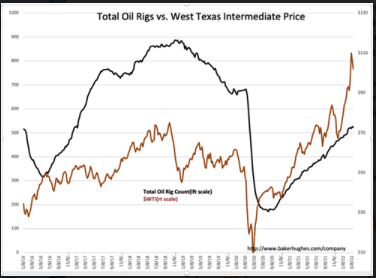

Baker Hughes Rig Count Unchanged-3 fewer oil/2 more gas and 1 more other. The rig count appears to only be offsetting natural well declines and continue to remain uncorrelated to $WTI. The SPR continues its decline the last 12mos at ~3mil BBL/Week. Declines in inventories provide the perception for many analysts the basis for predicting not only adequate supplies but expectations that rising prices and the rise in the rig count could create a glut by end 2022.

In my estimation, true supply is well below the demand anticipated once the global economy normalizes. The recent $WTI surge connected to proposed sanctions against Russia has settled $30/BBL lower causing some to announce the peak in inflation and $WTI is now behind us. Inflation and the oil supply/demand situation have deeper roots and investors should be allocated to hedge these issues for several years.