“Davidson” submits:

With the headlines very negative, it is worth repeating that this is not an economic meltdown. The market prices and earnings disappointments are in the favorites, the COVID shutdown issues, of the past 2yrs not in the core economic sectors of the US economy which are experiencing strong demand. Markets reflect market psychology of the moment. Many interpret stock price-trends as economic signals. The interpretation today is that falling prices in Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), Meta (FB), Google (GOOGL), Tesla (TSLA) and NVidia (NVDA) signal Economic trends. They do not.

What they do signal to Momentum Investors, who have been over-invested in these issues, is that revenue growth is not meeting expectations. Two headlines provide a good perspective of the Momentum Investor perspective that currently dominates pricing. The illustration of the valuation decline in the 7 COVID-favored issues, while a good visual, should be taken as a shift in market psychology, not a shift in economic activity, Economic activity as measured in employment, retail sales and goods transport continues to rise. Two key manufacturing sectors, aircraft and vehicles (personal light weight and heavy duty Class 8 trucks) are beginning to lift after 2yrs of supply chain issues. These sectors have significant supply/demand imbalances that will require several years to rectify. The E&P sector in particular is grossly imbalanced with rising demand continuing to outpace supply to such a level that US crude inventories just reported a 35yr low. High oil prices today can be expected to exceed the historical highs of June 2008 as the significant ramifications of government policies in the supply/demand equation force investors to recognize reality. The only cure for high prices is higher prices.

Stock Market Bottom Remains Elusive Despite Deepening Decline

‘Things are going to keep getting worse before they get better,’ one portfolio manager says

The Market Is Melting Down and People Are Feeling It. ‘My Stomach Is Churning All Day.’

Many are watching investments they meant for down payments, tuition or retirement shrink day after day

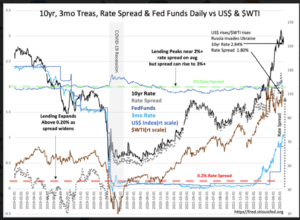

The best indicator for economic activity and overall market psychology is the T-Bill/10yr Treas Rate Spread. It has been very good at providing a measure of the market/financial cycle since 1953. Barring sudden government intervention, the rate spread i.e., yield curve, reflects the flow of capital into more speculative investment arenas. In turn, this reflects market psychology. Investors/businesses keeping a portion of capital in reserve for unexpected events hold T-Bill rates below that of the 10yr Treas, indicating a desire for higher returns and widening equity exposure. It is when reserves are deployed for higher returns, which leave investors exposed to unexpected events, that suddenly traps them in unexpected financial illiquidity, creating panic and forcing liquidation of positions. This condition occurs when the capital shift results in the T-Bill/10yr Treas Rate Spread narrows to 0.2% as investors commit T-Bill reserves. The current rate spread is 1.80% and has been rising even as T-Bills have been rising in response to inflation. What is occurring economically is reflected in the details of corporate reports, employment trends, goods transport, retail sales and prices of vehicles.

While Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), Meta (FB), Google (GOOGL), Tesla (TSLA) and NVidia (NVDA) disappoint expectations, much of the rest of the SP500 are reporting growth above expectations forecasting the same for 2022. At some point these issues become the new favorites, portfolio managers adjust and the SP500 rises as growth from these issues become widely recognized. The change-over from COVID-favored to Reopening-favored can be traced to the late Sept 2021-early Nov 2021 period in my estimation. Exxon Mobil (XOM) priced in the low $50s has just reached a new high $93.50+. Amazon (AMZN) by comparison was ~$3,500shr and now is below $2,200shr. Tesla (TSLA) was over $1,240shr and now is below $650shr.

Market psychology evolves. Each heavily favored issue finds a peak on its own with investors. Issues out of favor find bottoms and eventually become the new favorites. It is a process that requires time. Investors who have been through past transitions know that patience is required. The T-Bill/10yr Treas Rate Spread continues to signal economic expansion supported by economic indicators. Patience required! Market psychology of current headlines is that of Momentum Investors. Yet to be fully recognized is the market psychology of Value Investors who track economic trends. Once transitioned, we can expect to see new SP500 highs, but not necessarily new highs in Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), Meta (FB), Google (GOOGL), Tesla (TSLA) and NVidia (NVDA).