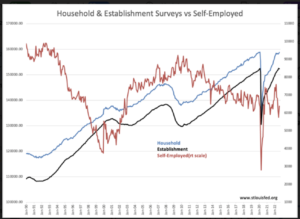

Davidson and I diverge here. I feel the collapse in self-employed people ultimately outweighs gains in “employment”. I do NOT view the current employment conditions as positive and think they have already begun to slip negatively.

Time will tell…

“Davidson” submits:

The employment trends continue with gains in both Household and Establishment series. The immediate market response is positive with the media having mixed views. The reports continue of layoffs in prior-COVID favored issues with Nvdia and Snap continuing to experience sharp declines on negative news from extreme pricing at prior 20x-30x revenue levels. The layoffs in the current market continue to be mostly isolated in COVID favored while labor demand remains in manufacturing and other sectors recovering from lockdowns.

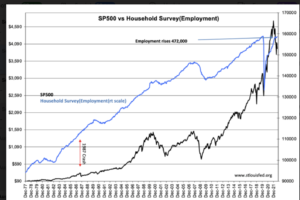

While many fret that higher employment will lead to higher rates and recession, the correlation of the SP500 vs Household Survey is quite clear that higher employment leads to higher equity prices. Employment weakens well ahead of market peaks and no signs of weakening are present in any of this data.

Excerpt from this report:

“Total nonfarm payroll employment increased by 315,000 in August, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, health care, and retail trade.”