“Davidson” submits:

A new extreme in market pessimism was registered last week in the SP500 Net Non-Commercial Futures. The consensus view has morphed somewhat from imminent onset of widespread bank failure to the issue of US default on its debt. Fear of another major equity price decline is the view as if market prices have yet to reflect the next catastrophe. The truth of the matter is in the details of past periods when investors were roiled by past unexpected crises. Panic never anticipates crisis. It only occurs after knowledge of the threat is widely known and investors have had a period to digest the portfolio ramifications. US debt default is a headline and already factored into prices.

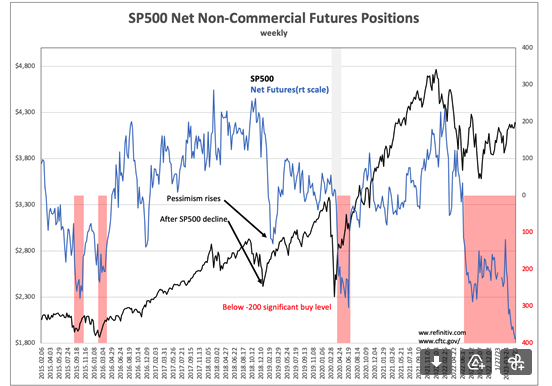

Once one recognizes that market prices reflect investor perception and not the ‘value’ of which all speak, then one can separate the two into Buffett’s ‘voting machine’ vs ‘weighing machine’. The ‘voting machine’ (Momentum Investors) respond after the fact. It is the ‘voting machine’ that closes the barn door after the horse has left. The ‘weighing machine’ (Value Investors) sees price as discounting long-term value. Last week the ‘voting machine’ added to their bet that the SP500 would suffer a significant decline from current levels with a new low of the Net Non-Commercial Futures Positions,-388.7. Meanwhile, the ‘weighing machine’ pushed SP500 higher. A new intraday high of 4212.91 since the Oct 3491.58 intraday low. The current market is a classic price struggle between the ‘voting machine’ vs ‘weighing machine’.

The historical record is clear. The ‘weighing machine’ always drives prices long-term. Panicky investors only develop after an unexpected event shakes their confidence in reliance on using levered positions driven by price trends. It is this panic that creates the market low but, as uncertainly spreads as Momentum Investors realize the issues price trends missed, it drives expectations of further declines from additional unknowns. Being that the most recent experience was a negative surprise, they expect yet another. The behavior of investors as reflected in the SP500 Net Non-Commercial Futures Positions spells this out.

The 2020 COVID crisis provides a case study in market psychology. The SP500 held up to the developing COVID news till Feb 19, 2020 when it peaked at 3386.16 only to plunge to 2237.40 on Mar 23rd with economic lockdown. The ‘voting machine’ did not respond in force till the week of June 19th, 3mos later, with a low that was 2mos after what NBER(National Bureau of Economic Research) would eventually declare the end of the COVID recession. While it felt much longer, the declared recession lasted 1 month. A similar delayed pattern to an SP500 decline is marked for 2018. Last week’s -388.7 Net Non-Commercial Futures Positions comes ~7mos after the Oct 2022 low.

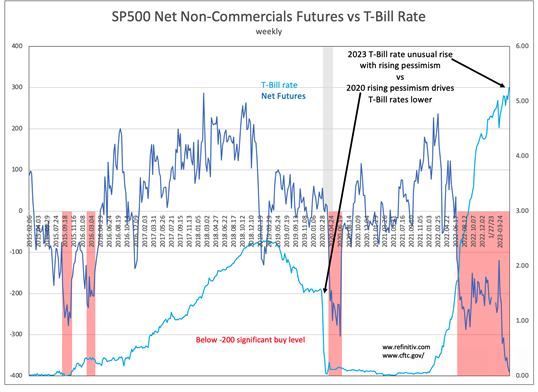

Not only is the ’voting machine’ responding after the likely market low, it has positioned a significant hedge which in turn is driving an unusual market imbalance. This is an imbalance never witnessed in the past during periods of extreme pessimism. Sudden onsets of pessimism have always resulted in a rapid decline in T-Bill rates as investors sought safety. This behavior is pointed out in SP500 Net Non-Commercial Futures Positions vs T-Bill Rate as recently as the COVID recession. T-Bill rates were ~2.45% Apr-May 2019 and declined on recession predictions unrelated to COVID to ~1.6% in late 2019. In 2020, as investors became aware of the import of economic lockdown, T-Bill rates of 1.58% on Feb 20th declined to 0.00% on Mar 26th. To place this timing in perspective, the low in SP500 Net Non-Commercial Futures Positions did not occur till well after, the week of Jun 19th. The unusual behavior this time is that T-Bill rates have risen to 5.24%. Instead of running to safety, the ‘voting machine’ has speculated on additional severe decline. The T-Bill rate rise comes from the stated strategy of shorting T-Bills to buy 5yr-10yr Treasuries that a further collapse in equities would benefit. In my opinion, this is a strategy which has no historical support.

Understanding markets and the ‘voting machine’ vs ‘weighing machine’ analog (attributed to Buffett but in fact comes from Ben Graham) requires laying events along a timeline and making the comparison between what was known and discussed at the time, the market response of investors and what occurred fundamentally. The commentary and actions of hundreds of CEOs provides a very useful collage with which to compare the dynamics the ‘voting machine’ claims are important vs the experiences of these CEOs. CEO commentary is as close to fundamentals as one can get.

The forecasted demise of the economy is always dire and without recovery coupled to a fierce price decline. The realty has always been CEOs adjusting to conditions on the run. If one listens, CEOs typically spell out an economic reality that often reaches the ‘voting machine’ delayed by 12mos-18mos. This leaves price-trend followers confused till economic reality enters the headlines. Nonetheless, the ‘weighing machine’ which does listen to CEOs, slowly produces its impact on prices which is what, in my opinion, we are seeing today. The SP500 has risen ~20% from the Oct 2022 low. The ‘voting machine’ continues to bet against prices while the ‘weighing machine’ buys. In recent days, noted ‘voting machine’ members have turned positive.

Despite the threat of additional banking collapses, the threat of US debt default and other threats known and unknown too enormous to contemplate, the ‘weighing machine’ is driving equity prices higher. In my experience, the better investor strategy has been to always invest with fundamentals not the headlines. Closing the barn door after the horse has left is not the best investment strategy.