“Davidson” submits:

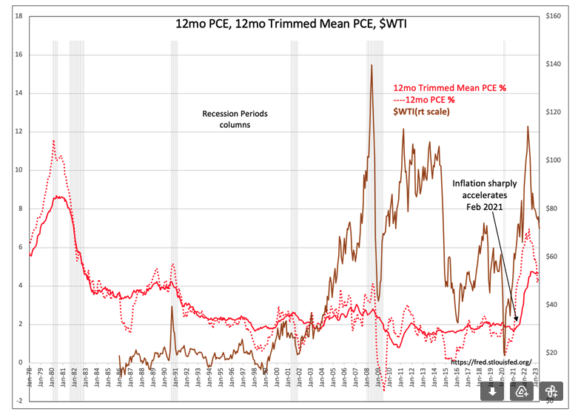

One of the great myths of finance, embedded over many decades of thinking, has been that the cost of oil, $WTI, is a major factor for inflation. It still is the Bogeyman in the dark closet ready to attack unexpectedly and the source of daily reporting. That PCE data posts inflation at 4.7% this morning when $WTI has round-tripped its price from Feb 2022 is worth putting the oil/inflation causality belief to the test. That inflation has not round-tripped has fallen on deaf ears.

Blaming the Ukraine/Russia conflict on inflation became the norm after Feb 2022. But, $WTI had already risen from below $40/BBL in 2020 to $96/BBL Feb 2022, before Russia began its action in Ukraine without a comparable impact on inflation. Now that $WTI is $20+/BBL lower than when the discussion was blamed on Russia, where is the reduction in inflation if oil is the culprit? Oil is not the culprit. The oil/inflation connection is a long-held misperception.

Only a few have pointed out that Milton Friedman’s inflation commentary is a policy not growth tenet. Perhaps it is because he did not express it exactly as that. He said:

Milton Friedman famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

The underscored-portion of Friedman’s observation has been quoted endlessly while the latter emboldened-portion is mostly ignored. The latter portion is the most important as it equates the imbalance in money to output as causality for inflation. The finest minds from the best business schools in finance do not grasp Friedman. If they did, no one would be confused that it is government spending and government policies on regulation that are inflationary as they do not result in matching improvements in its citizens standard of living. Government spending is more “robbing Paul to pay Peter” with no net societal gain and worse of all are regulations on businesses that impede societal improvements while raising costs. The argument is that regulations are required to ‘protect people’ and ‘make things better’ when instead they reduce the average individuals standard of living.

If one pays attention, oil prices and inflation while discussed as correlated are not. If one pays attention, inflation soared 100% in 1 month, Jan 2021 to Feb 2021, as the deregulatory actions of the prior administration were reversed with the swipe of an executive order. If one pays attention and looks at the timelines of government actions vs inflation, it is obvious that Friedman saw misdirected government policy as the cause of inflation.

Government-based inflation does not disappear with falling oil prices. It either works through the economy over time like the proverbial ‘pig in a python’ or government reverses its actions and stops it cold. Inflation is always a people-sourced issue at the governance level. Working people who spend earnings frugally are the source of bringing innovative ideas into the standard of living. The more people working to advance innovation, the greater the pace of deflation. The discussion of raising interest rates to force a rise in unemployment is without understanding inflation basics. Forcing unemployment is counter-productive and out of touch with reality in my opinion.

Unfortunately, the oil vs inflation myth and associated high interest rates/unemployment cure remains the consensus. Higher rates have already nearly eliminated net interest income at lending institutions as depositors have gone to higher paying money markets. There will be some slowing in the economy from this. Nonetheless, there remains a significant deficit in demand for goods and services post-COVID that continues to drive employment higher as consumers seek solutions to government caused inflation. The indicators despite inflation continue to point towards economic expansion.