“Davidson” submits:

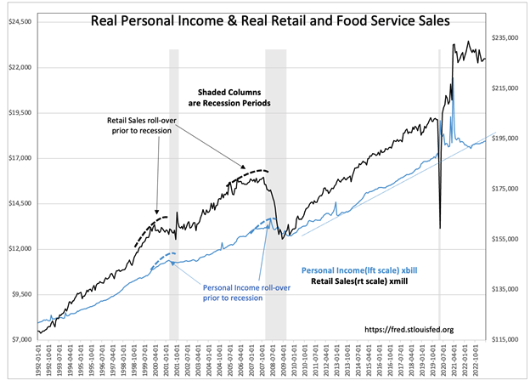

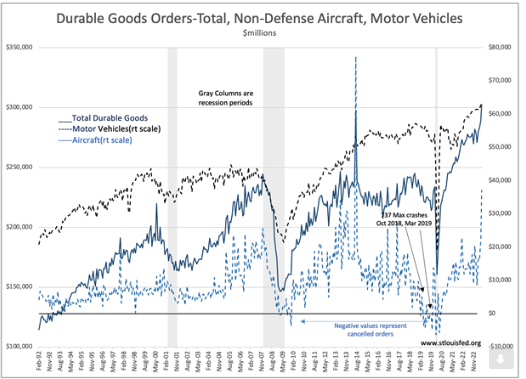

Manufacturer’s New Orders and Real Personal Income both reported higher numbers today. Advance Real Retail Sales and Real Personal Income, both corrected for inflation, continue to be flat to higher while new orders for vehicles and aircraft (including parts) are in decent uptrends. Durable Goods Orders includes vehicles, aircraft and other durable manufactured equipment of all types.

The comparison to prior recessions indicate there is no recession in sight. Forecasts for recession have declined rapidly as equity prices claw higher. There remains some skepticism as seen in the -263.7 level of the SP500 Net Non-Commercial Futures Positions and the inordinate high T-Bill rate which is part of an unusual hedge to protect against portfolio declines. That oil prices are rising, with declines reflecting another style of hedging equity downside, is an indication that some are reversing prior pessimistic stances.

The steady uptrends in Real Personal Income, durable goods orders and employment despite higher interest rates and persistent inflation indicate economic expansion continues. Equity prices have been responding since the Oct 2022’s low and the many basic industries reporting higher guidance supports higher equity prices lay ahead.