“Buy fear and sell greed” Warren Buffett

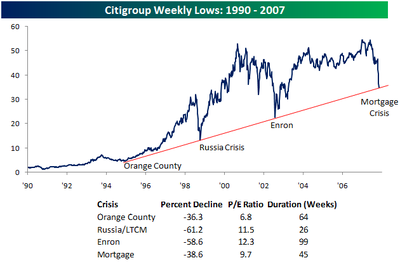

I found an very interesting chart over at Bespoke Investments. It contrasted today’s “crisis” with past ones (LTCM, Orange County & Enron). The chart (below) illustrates that this sell-off in Citigroup (C) shares is in keeping with past ones and also shows the rapid accent after the “crisis” passes.

Is Citi is trouble of failing? Not by a country mile. Let’s not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3% is safe as Citi has a plethora of options to use to pay it. Let’s not forget, aside from writing down the CDO’s, the rest of the banks operations are performing very well and the international operations are going gangbusters.

What if Citi has to sell off assets to meet obligations? Isn’t that what people want to unlock the value in it? They won’t but even if they do, let’s say they sell $50 billion in assets. That whopping amount comes to 2% of Citi’s total asset base…. am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

Citi could issue $200 billion in debt to provide funds and even with that, it assets base would still be twice its debt level.

The thing of it is, a billion dollars used to be a lot of money. It just isn’t that much anymore when you are talking about institutions sitting on trillions. Some perspective is in order.

2 replies on “Today’s Citigroup Buyers Will Be Rewarded”

That’s a rather convenient display, but try it using a log scale. It doesn’t quite look the same …

todd,

not my chart… thought that was clear