Starting to get more color on what the structure change will mean to the profitability of the business going forward.First the news. Jamba Juice (JMBA) opened its website today for potential franchisees (here if you are interested). In it are some financial disclosure that shed some light on just how profitable it will be selling these locations. Here is the release sent out

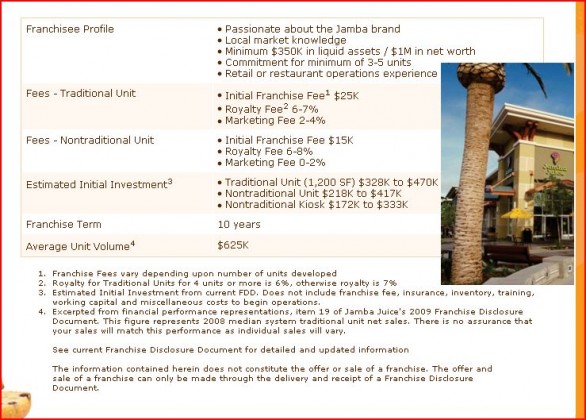

Let’s start with some easy math. Jamba says it wants to open 40-45 franchise locations this year in addition to selling 125 currently company owned stores to franchisees. Here are the financial obligations from the site:

We are going to look strictly at the “Traditional” units since they provide the most information for them. For our purposes we will assume Jamba sells at the low end of their goal and hit 40 new franchises.

They receive $1m in franchise fees and $1.6m annually for the royalties. When we also consider the 125 company owned stores to be sold (assuming they do sell them), we can add another $5.2 million in annual royalties and$3.1 in sales revenue (125 x $25k).

That essentially means an additional $4.1 million immediately and then $6.8 million annually in additional revenue for the company. Big deal you say, the company had $340m of revenues last year. Here is the thing, they will be reducing that amount by $81 million (125 units sold averaging $645k a year). So that $81m of lost revenues is being replaced with $11 million in the first year. How is that good? That $11m is virtually all profit. We can also add in another $3.1m in advertising fees that will offset costs at the corporate level.

This is just year one, the $14m million is recurring revenues with very little cost associated with it. If we add another 50 locations next year (low ball guesstimate) we can add $3 million annually to that number (plus $1.25m in sales).

Note: All these calculations pertain solely to the “Traditional” locations, the “Non- Traditional” ones will have much smalled sales and royalty payments.

Let break it down further from the 10q:

For each dollar brought in at the corporate store level:

Cost of sales= 23.6%

Labor= 31%

Rent = 12.4%

Utilities/credit card fees/maintenance etc. = 12%

Total= 79%

That is just operating costs and this is what the franchisee will see….looks good after fees they clear about $.12 on every dollar (their costs will vary, this is just an estimate based on the best #’s I can get).

But, because these are corporate stores, we have to add in these other items that affect profitablitly,

Depreciation/amortization = 5.2%

SG/A= 9.8%

Impairment of LL assets= 9.1%

Total= 24.1%

Add it all up, and we get a loss on that $81m in revenue on the books. Note: Because of the economy, assets value are being written down, should it improve and cash flows from them also, these write-downs will not occur and perhaps will be written up. But until that happens, here is where we are.

Now does the franchise model make more sense? Rather than using cash/human resources to lose $$ on that $81m in revenue, why not make essentially $11m clean?

As more franchises are sold, that number grows annually still with very little cost associated with it. When we get into the 1000 franchise numbers, we are talking roughly $61m annually (not including franchise fees of $25m on 1000 franchises)…..

But wait, there more….. (to steal a line from Steve Jobs)

None of the above numbers include the addition of food to the stores (just rolling out now) which will increase revenues (royalties) OR the licensing of products to be sold in grocery stores nationwide… ka-ching?!?