A picture is worth a thousand words….. or in this case, millions of dollars

This goes to the essential investing thesis in Etrade (ETFC). As long as the positive trends here continue, Etrade’s performance will continue to improve.

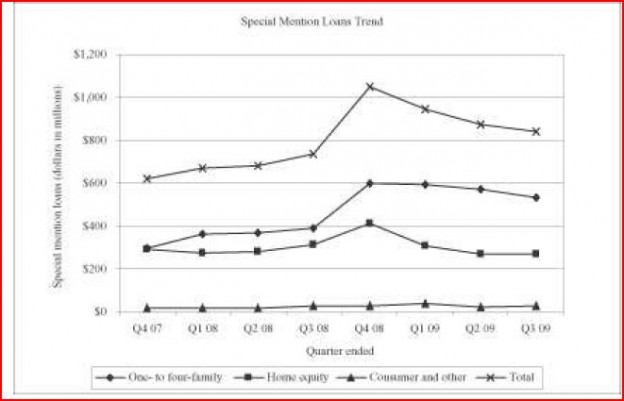

The trend in special mention loan balances are generally indicative of the expected trend for charge-offs in future periods, as these loans have a greater propensity to migrate into nonaccrual status and ultimately charge-off. One- to four-family loans are generally secured in a first lien position by real estate assets, reducing the potential loss when compared to an unsecured loan. Our home equity loans are generally secured by real estate assets; however, the majority of these loans are secured in a second lien position, which substantially increases the potential loss when compared to a first lien position.

During the nine months ended September 30, 2009, special mention loans decreased by $207.1 million to $827.9 million. This decrease was almost entirely due to a decrease in home equity special mention loans. The decrease in home equity special mention loans includes the impact of our loan modification programs in which borrowers who were 30 to 89 days past due were made current .

While our level of special mention loans can fluctuate significantly in any given period, we believe the decrease we observed in the first half of 2009 is an encouraging sign regarding the future credit performance of this portfolio.

The following graph illustrates the special mention loans by quarter: