“Davidson” Submits:

Although what is presented in the media is an economy that seems to twitch with every 100pt move in the Dow Jones Index, This is simply not what happens. Economies have broad cycles that once begun in a particular direction, expansion or contraction, continue in the same direction till the levering-up or the levering-down is exhausted. Primarily this is reflected to changes in employment levels, but can be viewed in almost all economic data series if one knows what to look for.

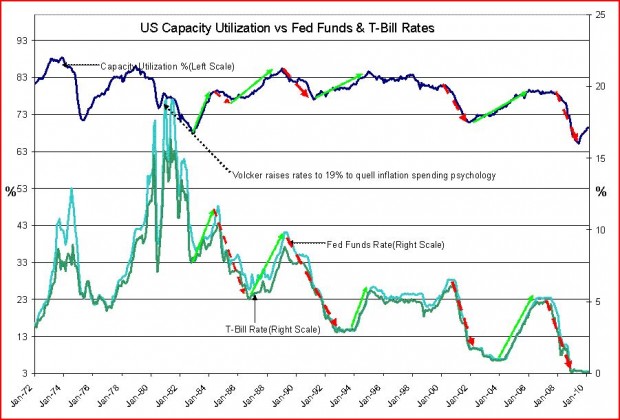

US Capacity Utilization vs. T-Bill Rates represented in the chart below is one of the economic relationships I find quite useful in gauging where we are in the business cycle. There is a clear relationship between the cycles in US Capacity Utilization and the cycles in T-Bill and Fed Funds’ rates over the business cycle. Understanding this is quite simple and provides an investor with a broad based confidence when making investment decisions in the face of uncomfortable market volatility of the type we have just experienced.

Understanding this relationship is quite simple as are most aspects of the stock market if one’s perspective is the “Business Cycle”. The Business Cycle is from one low level of the economy to another and is reflected in the US Capacity Utilization. The period of the Business Cycle varies and it is a mistake to think of it in terms of an average number of years. There are many inputs that can lengthen or shorten any particular Business Cycle or even separate components of the total cycle. For example, the Internet Bubble with the rampant capital flows into technology skewed aspects of the Business Cycle and itself may have had psychological underpinnings in the rush to cure poverty thru equally rampant sub-prime lending. Just how important an input government largess can be, is seen in the fact that while there was a recession in 2002-2003, auto and light truck sales rolled merrily along(chart on request). Lenders not only provided cash for unqualified individuals to purchase homes(REITS rose merrily along as well), but in the spirit of the time lenders also threw in lending above the appraisal rate such that unqualified individuals could buy an SUV to boot. No one predicted these events ahead of time and even now few have truly connected the dots correctly.

Predicting what will develop during each Business Cycle based on what little is fully known at any particular stage is nigh impossible. But, what we can do very effectively is to observe causal relationships, understand the economic implications that create them and in a broad sense make reasonable estimates of where we are in the Business Cycle. The US Capacity Utilization vs. T-Bill Rates(and Fed Funds Rates) are correlated by the simple fact that when business slows, capital needs to be stored in safe and liquid security. T-Bills suit this need perfectly in the US and T-Bill Rates fall when used for capital storage. When capital is needed for business expansion, T-Bill Rates rise as corporations sell T-Bill and move the capital into bringing idled capacity back into operation. This means using capital to build raw material inventory, rehire idled employees and reactivate other needs for business recovery. The relationship is very simple, very powerful and very useful.

Importantly, rates are set by this activity not by the actions of the Federal Reserve. Just as a great myth of the market is the belief that stock market movements predict the economy, the myth that the Federal Reserve dictates rates and causes business recoveries or declines by its actions is not what we see in experience. Rates are set both by business activity and investor activity and the Fed sets rates in response to the prevailing rates in the market in my experience. The market’s rate setting mechanism was first observed by Adam Smith in “The Wealth of Nations” and explicitly stated by Knut Wicksell in 1898. The Dallas Fed calls Wicksell the “Father of Modern Monetary Policy”. You may be assured that the market rate setting mechanism has been in operation at least since the Sumerians over 5,000yrs ago. The fact is that we still do not seem to understand and grasp that our confusion of market basics can be attributed directly to our reliance on mathematical representations of all unknowns both physical and psychological.

When one steps back, our markets can be seen to be psychological creations. Purely psychological!! From the very lowest of financial relationships between a day worker and employer thru corporations to global financial market relationships, all is based on trust and perceptions of value that can be described in one short phrase, human psychology. This is not a system that can be quantified as the physical world can be perfectly quantified, even down to how atoms interact with atoms. This is why the application of complex mathematics to the study of markets has been a failure the past 100yrs and will always be a failure. This does not mean that we cannot discern some relationships that seem to hold over longer periods. There are relationships that hold within certain ranges and over longer periods of time, but their lack of precision is enormous. Once one begins to observe markets as pure human constructs with the lack of precision that is a significant complement to the definition of human skills, then one can let go of trying to grasp the details and every market nuance, and accept the broad undercurrents.

The relationship below between US Capacity Utilization vs. T-Bill Rates(and Fed Funds) is one of those broad undercurrents. It is very descriptive of how we act as a society, our behavior. When we are scared, we seek safety. When we are confident, we are outgoing, willing to take risks and commit ourselves to future obligations. This chart shows we are still in the early stages of economic recovery. T-Bill rates should rise as confidence builds. Capital should move out of T-Bills to reenter the economy and the equity markets as both investors and corporations are using T-Bills for capital storage. The current super low rate of 0.15% should eventually rise to ~4%-5% range in my experience. Current reports indicate that some $2Trill sits on corporate balance sheets most of which is used in normal operations that are at the moment idle. In addition to this $2Trill, the estimates are that some $5Trill of investment capital that would normally raise the SP500 to ~1600 is sitting in T-Bills. Even in today’s perception, this is a lot of economic powder!