“Davidson” submits….

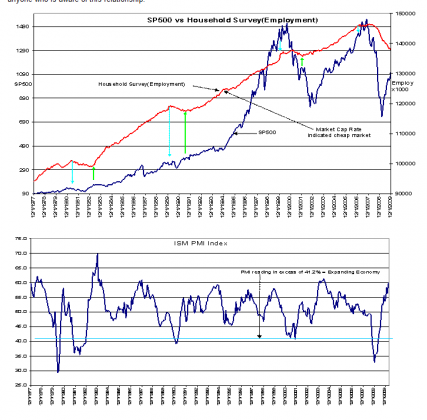

The basics are that the market rises and falls with economic momentum as investors perceive changes in employment. The ISM PMI calls economic bottoms fairly closely, even in instances such as the Iraq war in 2003. The economy was in recovery, but investors feared to invest and drove stocks down till it was clear that Iraq would not impact the economy. In fact, the economy showed virtually no impact at all. The Help Wanted Online (HWOL)appears to be a coincident indicator for SP500 and economy.

There was one Household Survey head-fake in 1994 when sudden slowing in job growth occurred as a Greenspan rate rise triggered a partial investor exit, but the Market Cap Rate (MCR) at that time indicated that the market was undervalued and would have kept you invested.

The market bottoms are indicated by HWOL bottoming out, PMI turning above 41.2% and usually accompanied with turns in copper, oil and Baltic Dry Index and can be supported by the MCR, but attractive MCR valuation is not necessary. Market tops are clearly tied to slowing/stalling employment growth and knowing when this turns is the most important fundamental information for Business Cycle investors

Importantly there are a number of indicators like “Dr. Copper” that only provides useful insight when only a few investors are paying attention to it. This is like the Heisenberg Uncertainty Principle:

In quantum mechanics, the Heisenberg Uncertainty Principle states by precise inequalities that certain pairs of physical properties, like position and momentum, cannot simultaneously be known to arbitrary precision.

When too many investors are using an investable indicator, the information it actually provides morphs from being independent of investor thinking to one that reflects investor expectations. It is always a dangerous condition when investors believe the indicator’s trend is independent of their own expectations.

Investors are a diverse group and sensitive to signs of economic momentum. Fundamental investors will jump in when they see a positive turn and exit when the turn is negative. Other investors follow market momentum and enter when momentum is favorable and exit when not. Those waiting for the earnings evidence are late to enter and late to exit. They likely have the worst performance waiting till the earnings signs are positive and pushed out only as earnings disappointments force stocks down causing portfolio liquidations. The diversity of investment styles causes different groups of investors to support the market at different times in the economic cycle.

The market tops and bottoms reflect a combination of investor perceptions, but it appears that the bulk follow perceptions of economic momentum and not valuation. Over the longer term the market does track the MCR, but I have yet to meet anyone who is aware of this relationship.

2 replies on “$$ Market Dynamics….Some Thoughts”

[…] This post was mentioned on Twitter by Todd Sullivan, adamsussman. adamsussman said: RT @ToddSullivan: $$ Market Dynamics….Some Thoughts http://bit.ly/cHySvs […]

[…] $$ Market Dynamics….Sοmе Tһουɡһtѕ Value Plays […]