Time frame…..

“Davidson” submits:

Retail and Food Service Sales were reported down 1.2% for May 2010. The market has not digested this information well. In this as in most perceptions the advantage goes to those who look at the trends in the larger framework. For Long Term Investors today’s market decline should be seen a positive event with which to add additional capital and buy shares sold by Short Term Investors who by nature are very short term oriented.

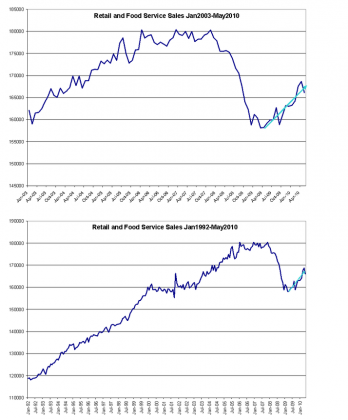

The St Louis Fed data is presented below over two periods . The first is Jan2003-May2010 which covers from the middle of the last recession to date. The second is Jan1992-May2010 which covers the entire data series. It should be obvious that this data like most economic series have always been somewhat choppy and no single data point is useful in itself.

There are 3 comments of importance to longer term investors:

It can be seen that the near term volatility in this series is very similar to that of the entire series from 1992.

The series trend is definitely in an up-trend today and having started in April2009 is likely to continue as it has historically.

Long term investors should take advantage of short term trader pessimism!!

One reply on “$$ More on Retail Sales”

[…] High net worth individuals keep on spending. (MarketBeat also Value Plays) […]