This is great….another example of why these have to be ignored, blindly follow them at your own peril..

Both of these released today:

BPO current price $14.89

Brookfield Properties Target Raised To $20 From $19 By Canaccord Genuity

Brookfield Properties Target Cut To $14.25 From $15.50 By UBS

So, who to believe? If you only saw the UBS news did you just dump shares? If you saw only the Canaccord news and like the 33% upside they predict did you just pile into shares?

Clearly since I own shares (since $9.76) I would tend to agree with the UBS outlook. However, this cannot be the basis for your investing decisions since these targets are changed constantly. Of course we now also have to note UBS placed a “sell” on BPO with a $7 price target last July (we bought soon after).

You safest bet is to utterly ignore these and recognize there are plenty of lemmings out there who will react either way to these “targets” and more likely than not regret it. If we look at the “target” history of BPO, we see it going steadily up since last July . It isn’t going up or down over time due to price target changes but because the fundamentals continue to improve. It’s actually pretty simple. The price target changes follow the rise of the stock, not precede it, remember that and act accordingly.

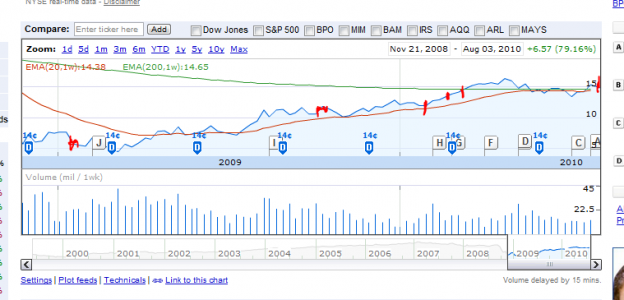

Visually, here are the price target increase (red marks) following the price of the stock upward: