We have to back a few moths for some thoughts on this. Let’s go back to the Credit Suisse report on GGP/Howard Hughes. Now, this is not meant to bash CS as they made some assumptions the admit may have been “very conservative”. OK, but we need to look at now HOW conservative they may have been. CS valued the land in the MPC segment at 69k an acre.

NOTE: The original post and CS report were written when GGP planned a 1 for 1 spin. It is now a 10 for 1 spin. For easy math one must multiply CS #’s for HHC by 10 get get updated value for today.

From today’s HHC (Howard Hughes Co.) filing (pages 7-10 of filing):

On May 10, 2010, certain of the TopCo Debtors entered into purchase agreements with two proposed purchasers, Richmond American Homes of Nevada, Inc. (“Richmond”) and PN II, Inc., dba Pulte Homes of Nevada (“Pulte”), for the sale of certain lots in our Summerlin master planned community. The purchase agreement with Richmond is for parcels comprising 115 and 117 lots representing 32 acres in the aggregate for purchase prices of $8,510,000 and $9,477,000, respectively. The purchase agreement with Pulte is for parcels comprising 109 and 162 lots representing 31.5 acres in the aggregate for purchase prices of $7,739,000 and $12,231,000, respectively. As of October 4, 2010, the applicable TopCo Debtors have closed on the sale of 50 finished lots to Pulte and 20 finished lots to Richmond with gross purchase prices of $4,219,000 and $2,133,000, respectively. Both purchase agreements provide for closings of the remaining lots in stages through 2011.

So…..lets do some math.

- Richmond paid $17.9m for 232 lots over 32 acres (each lot = .138 of an acre) or $562k an acre.

- Pulte paid $19.9m f0r 271 lots over 31.5 acres (each lot = .116 of an acre) or $633k an acre

- HHC sold finished lots to Richmond for $2.1m or just over $1m an acre

- HHC sold finished lots to Pulte for $4.2m or ~$840k an acre.

- There are 6559 more acres to be sold in Summerlin. At only 1/4 of the current selling price ($150k), the remaining acres could bring $974M (CS valued it at $488M). At current prices and a fully diluted 45M shares (including warrants), HHC is valued at 1.7B. The quick back of the napkin look means 1/2 of HHC’s current valuation is a fairer value for Summerlin land. Remember, this assumes HHC sells the remaining acres at only 1/4 of what they are selling them at now.

Now, admittedly we can’t jump from 20 lots to 200 and say the whole thing is worth “x”. I think we CAN however, say that the $69K figure CS used is not only “conservative” but stunningly so. With lots going for near 10x that, the Summerlin area is worth multiples of what CS gave it credit for.

Note: I know they will not sell out the rest of the acreage this year (or in the next few) and that revenues will be realized over time. I also know that the longer they take to sell some, the higher they will sell them at and that the particular acres location will determine pricing variations. The point of the exercise is to try to put a # to a huge swath of land and a company based on current activity. With the additional valuations below, it does give us more of an idea/comfort that HHC has some serious upside. The Summerlin exercise also does not take into account the 625 acres of retail space they can still sell/develop.

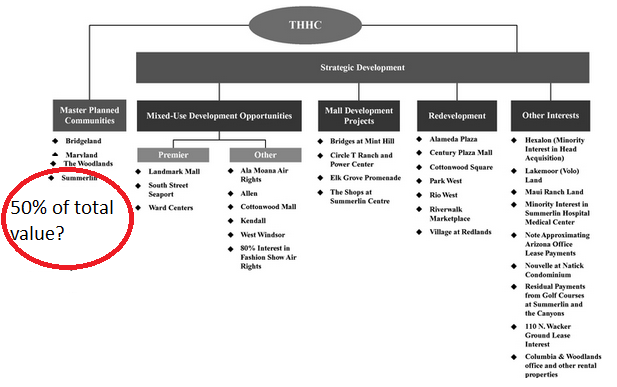

Other valuations:

- South Street Seaport, 285,000 square feet in downtown Manhattan (a quick walk from Wall St.), carries a book value of only $2.9 million.

- Ward Centers is situated along Ala Moana Beach Park and is within one mile of Waikiki and downtown Honolulu. The Ward Neighborhood is the site of Ward Centers, a chic shopping district of six specialty centers with over 135 unique shops (many found only there) and 22 restaurants. In January 2009, the HCDA approved a 15-plus year master plan by Victoria Ward, Limited to transform the 60-acre site into a vibrant and diverse neighborhood of residences, shops, entertainment and offices. This is carried at $319m. It true value should be followed by a number and then a “B” ……not an “M”.

- Alexandria, Virginia unanimously approved a small area plan in February 2009 that authorized up to 5.5 million square feet of mixed-use development on the site currently occupied by our Landmark Mall. This site is located just nine miles west of Washington, D.C. and the Pentagon, and is within approximately one mile of public rail service on D.C.’s metro blue line. We have certain limited entitlements to construct buildings as tall as 25 stories on some parcels, subject to acquisition of the 30 acres of adjacent lands from the anchor store owners and demolition of their existing structures. Although plans continuously evolve as market conditions change, it is illustrative that our entitlements envision about 800,000 square feet of retail and other commercial space, 500 hotel rooms and 1.2 million square feet of residences. These could be developed by us or sold to others for development. Carried at $48M. I used to live down there…this is highly sought after property for both residents and retailers.

- Circle T Ranch, which contains 128 acres and Circle T Power Center, which contains 151 acres. The sites are ideally located at the intersection of two high traffic highways, which will allow for easy access and high visibility for the property. In 2009, Circle T Ranch’s trade area encompassed approximately 870,000 people and 308,000 households. From 2009 to 2014, the trade area population is expected to grow at a rate that is over three times the national average. By 2014, Nielsen™ estimates this trade area will add more than 144,000 people. The 2009 average household income within seven miles of the site is $131,100, which is approximately 89% higher than the estimated 2009 average household income for all U.S. households. This is carried at $9M (HHC’s 50% ownership)

- 11% of HHC property value is debt. After 2010, no significant maturities until 2014. Avg. interest rate 5.4%. This means there is significant room to take on debt to develop/acquire.

Up until now there has not been a ton of information out there on HHC for us to get some idea of what we think a valuation could be. With what we have here and in the recent filing readers can come to come conclusions. Mine is that there is a material undervaluation here. Much of is being carried at 2004 levels (2+ yrs. before the CRE peak) so even with the fall in prices out there, the carrying values on most of what HHC holds still hold up. Only the Bridges at Mint Hill, Allen in Dallas and Park West in AZ are 2006 or later properties. Once we begin to add the development possibilities, now that it will happen, we can add serious upside to those values.

2 replies on “$$ Howard Hughes and Summerlin”

[…] This post was mentioned on Twitter by Todd Sullivan and Sean Broderick, CCIM, John Reeder. John Reeder said: RT @ToddSullivan: $$ Howard Hughes and Summerlin http://bit.ly/94rvVs […]

[…] as a primer it may be helpful to check out Todd Sullivan’s discussion of the value of HHC’s land […]