“Davidson” submits:

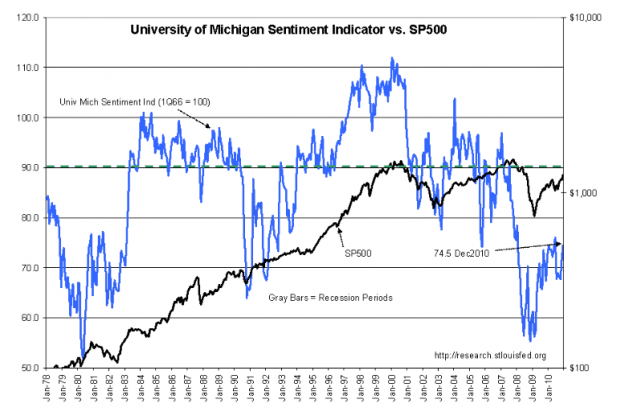

The University of Michigan Sentiment Indicator was reported on December 23rd, 2010 with a relatively low reading of 74.5. Often the media has interpreted weak sentiment as a harbinger of a weaker economy and weaker equity markets. I do not think the evidence supports this conclusion.

The University of Michigan Sentiment Indicator vs. the SP500 is plotted below with gray bars marking the official recession periods. One can observe a fairly strong correlation between the rise and fall of consumer sentiment with the corresponding rise and fall of the SP500. In fact, one can discern that consumer sentiment often follows the SP500 with a lag of ~1mo. Consumer sentiment therefore seems to reflect the investment markets and other news worthy events rather than be a leader of the SP500.

Actually, one can make a strong argument that weak consumer sentiment is more an indicator of future rises in equity markets. One can also argue that markets and the economy since the mid-1980s have not experienced prolonged down periods till there has been a multi-year period in which sentiment has exceeded 90. The current reading of 74.5 in my view is an indication of the current investor pessimism and a harbinger of stronger equity markets as the recovery progresses.

University of Michigan Sentiment Indicator is a follower not a leader of equity prices!

The current reading of 74.5 suggests stronger equity markets!

One reply on “Michigan vs S&P”

[…] This post was mentioned on Twitter by Stocktwits. Stocktwits said: U of Michigan Sentiment vs S&P http://stk.ly/eDZYCa via @toddsullivan $SPY $SPXU […]