“Davidson” submits

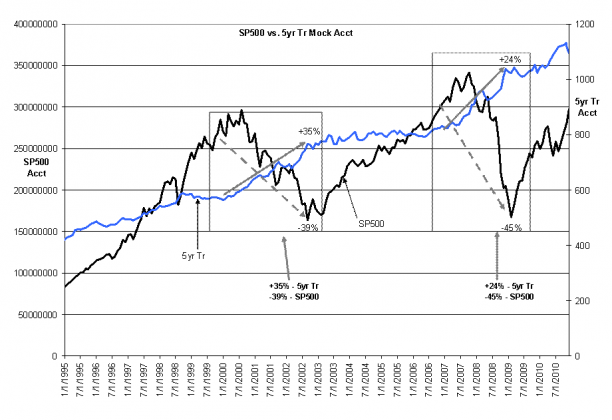

I ran this study of 2 accounts, each simulating a rate of return, one for the SP500 and one for Citi’s 5yr Treas Index. The goal was to do a “What if?” scenario to assess the net effect of exiting SP500 using a combination of the inverted yield curve, a fall in auto sales from the most recent trends and a flattening of Household Employment Survey after reaching historical “full” employment levels at which point one would Sell the SP500 and Buy a portfolio of 5yr Treasuries. One Buys the SP500 and Sells the 5yr Treasuries when Purchasing Managers Index, Retail Sales data and the Market Cap Rate and other early economic indicators have provided signals of market lows.

What is clearly apparent is that the 5yr Treasury rises briskly during market sell-offs and offers a positive alternative to portfolios during periods of economic correction.

Using this approach to benefit an account is entirely dependent on how good one is at identifying the appropriate inflection points, but one can see that SP500 positions can be exited well before highs while still retaining a benefit.