Exxon had an analysts day and CEO Tillerson was on CNBC. We had an original goal when we bought Exxon at $60 of $90 that after Q4 results we think is now north of $100. The current Middle East situation IMO is being overplayed in the market and I do not see a good way to play it now if you have not already. There are two very real scenarios, the first, Quaddafi comes back into power and everything settles down OR unrest spreads to Saudi Arabia and it blows up. Either way, I do not want to get caught on either side of that trade as it will be a viscous outcome.

Holding Exxon here for me is just fine as I think they benefit either way. If oil prices rise they are printing money, if they fall, demand for oil goes back up and they are printing money. Either way it works out.

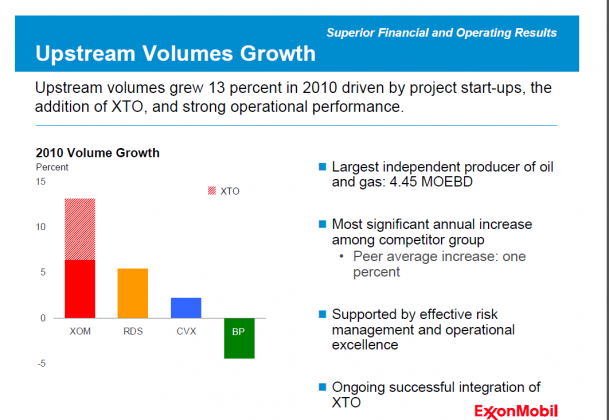

Check out the .pdf below from today’s analyst meeting. The bear case seems like it comes down to two themes, their replacement cost for reserves it too high and the XTO deal (although lately that one seems to be coming down a bit). Look what the XTO deal did for volumes in 2010:

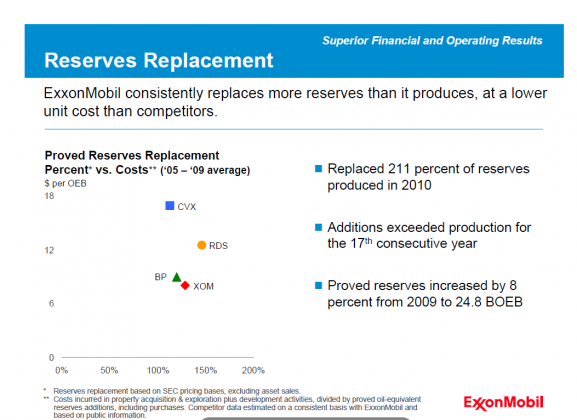

Regarding reserves, XOM replaced >100% of its production in 2010 at an industry low cost basis…

XOM still has plenty of room to go from here…..

XOM Analyst Day 3-9-11 (click to open .pdf)

Tillerson on Energy Independence

On the Middle East:

On oil speculation: