Perfectly simple solution……..which is why it will never be enacted…. unfortunately

Although markets appear extraordinarially complex, once one looks through all the issues there can be very effective but simple fixes if the regulators can be

convinced of their usefulness.“Davidson” Submits:

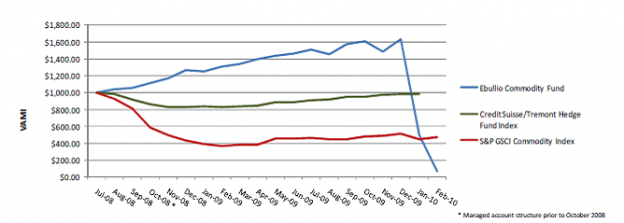

Feb 2010 Ebullio Capital reported 86.25% loss of investor equity and provides a stellar example for a personal observation:

I extracted Ebullio’s record thru Feb 2010. Although Ebullio did not reveal important details, my guess is that their leverage use was very high and that a small move in the markets against their positions in this commodity based portfolio virtually wiped out investor equity.

If a level of transparency similar to that required by mutual funds, i.e. positions reported 45dys after the end of the quarter, became a requirement for hedge funds(HFs), then many HFs would in my opinion become uncompetitive primarily because secrecy is a critical and necessary component of many highly leveraged niche position methodologies. To reveal exact positions and leverage use would leave any HF open to counter arbitrage by competitors seeking any opportunity to gain performance advantage. The so called “proprietary methodologies” practiced by many HFs are in fact easily duplicated or collapsed by any of the hundreds of other “Quants” trolling the markets with mathematical training and juiced-up lap top once a particular portfolio is exposed to the light of day. The implementation of many such “proprietary methodologies” makes the investment markets prone to instability in my experience.

The heavy reliance on secrecy required to implement mathematical models (Quantitative Models and from which the term “Quants” is derived) has an inherently destabilizing effect on markets. Scott Patterson reveals this effect in his excellent first book. “The Quants”. Each “Quant” tends to operate with the belief that 1) His/Her strategy is unique and 2) The marketplace is always liquid for the particular strategy. But, secrecy prevents each “Quant” from knowing what other managers are doing and how much capital is operating in any particular market. “Quants” uniquely have the reverent belief in mathematical model’s ability to reveal “the Truth” to market values. They routinely ignore the fact that markets are human based structures with inherent unfathomable psychological underpinnings which do not follow mathematical models but only seem to over short periods. Finally, add to this volatile mix the fact that mathematics itself is rigid and that markets can only be sliced/diced mathematically to a limited number of general strategies which tends to funnel all managers unknowingly into too few strategies that can only produce reasonable returns using ever high levels of leverage. The Net/Net is a build-up of an invisible inverse pyramid of market instability that works only if the market’s psychological sense of valuation continues apace. But, should a perturbation in one sector occur, i.e. The ratings on sub-prime are wrong!!!, then the market’s valuation psychology changes. Psychology almost always changes much faster than markets can anticipate. Illiquidity can rapidly develop in over-levered positions. When a multi-strategy manager cannot gain the liquidity necessary in particular strategy, liquidity is sought in alternative strategies. The sudden and unexpected behavior of positions vs. Quant Models for other unrelated managers in turn forces them to unravel their portfolios. A chain reaction occurs across all strategies with dazzling speed. Liquidity is forced on all, suddenly, because secrecy kept each from knowing that the strategy was too crowded and too levered. Had they been aware of each other’s positions, each would have adjusted their exposure to risk accordingly. Public exposure would have made many strategies untenable or even self-destructive if exposed to competitors.

Secrecy should not be a permitted element of investment methodology. Secrecy permits the use of methodologies and leverage that would not possible without. Such investment activity is inherently destabilizing for free markets. Secrecy provides unfair advantages for large pools of capital which operate well out of the regulatory régime established for all other traditional methodologies which must file under the Securities Exchange Act of 1934.

Transparency may not have prevented this fund’s collapse, but it could have provided enough information for most investors to avoid placing funds in what I assume was this manager’s highly leveraged investment style. With all the finger pointing of who did “what” with “what” that resulted in the recent financial collapse and credit freeze, I think a great deal of what occurred in secrecy would not have transpired if a policy of exposing every manager’s activity to public scrutiny in close to real time had been in effect. I call this free market process “The Transparency Effect”.

“The Transparency Effect” is the free market process of balancing Return vs. Risk. When secrecy prevents the dissemination of critical Risk related information, i.e. the amount of leverage used to generate Returns, investors who would normally not assume the Risk associated with the use of high leverage are deceived . They are deceived into making investments which are “unsuitable”. The particular manager who is able to withhold critical information claiming it to be coupled to a proprietary methodology is often allocated much more capital by the market than that manager would otherwise have obtained as the market under-estimates the Risk.