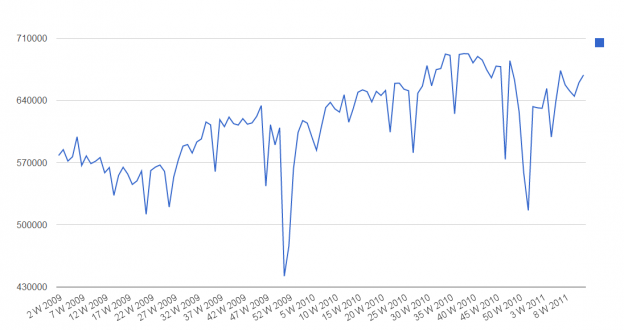

As we going to get the dip from the Japan tragedy I keep expecting? If we do not, that simply means that domestic activity is countering the loss imports from Japan. Given the levels of increases we are seeing in rail traffic, if Japan has no appreciable downside to results, that simply means the economy is picking up steam.

This matters as traffic was up 1.7% WOW and 3.2% YOY (20% growth over 2009). Let’s remember that the growth over 2010 was when GDP was growing at a 2.7% annual rate. Now there is the GDP effect for Q1 and Q2 2011 that Japan will have (lower imports from there will increase GDP) but that is not going to be the real story (it will for the media headlines). The real story is that if we do not get the Japan drop I expected in rail traffic then we are seeing significant underlying strength in the US economy. That bodes very well as we begin to look at Q3 and Q4 for this year. As for the “what’ was being carried in the rail increases came from all sectors except food which showed a small, immaterial decline.

More evidence?

From, the KC Fed this am:

Growth in Tenth District manufacturing activity accelerated rapidly in March, posting a record high for the second straight month. Expectations moderated slightly from last month, but still remained solid. Price indexes for raw materials reached historically high levels, and more firms indicated plans to pass cost increases on to customers.

The month-over-month composite index was 27 in March, up from 19 in February and 7 in January. This reading set a new all time survey high. … The employment index inched higher from 23 to 25, also a new survey record.

Growth in most year-over-year factory indexes increased from the previous survey. The composite year-over-year index moved higher from 21 to 30, and the shipments, order backlog, and employment indexes also increased. The capital expenditures index edged up for the second straight month, while the new orders index remained unchanged. The new orders for exports index eased from 22 to 12 after matching an all time survey high last month. Both inventory indexes increased considerably.

Also:

Chicago ISM: The overall index decreased to 70.6 from 71.2 in February. This was slightly above consensus expectations of 70.0. Note: any number above 50 shows expansion, so this is a strong reading.

“Employment grew to its second-highest level since February 1973.” The employment index increased sharply to 65.6 from 59.8. This is the highest level since December 1983.

“New orders increased to the highest point since December 1983”. The new orders index decreased to 74.5 from 75.9.

“Skilled labor is beginning to be hard to find, and domestic Raw Material deliveries are not being met and Lead Times are increasing beyond reason (32-48 wks.) and our customers are becoming unsatisfied.‖”

And:

First time claims continue to fall

In the week ending March 26, the advance figure for seasonally adjusted initial claims was 388,000, a decrease of 6,000 from the previous week’s revised figure of 394,000

You can expect a good NFP number tomorrow also and we just had Q4 2010 GDP revised up from 2.8% to 3.1%