“Davidson” Submits:

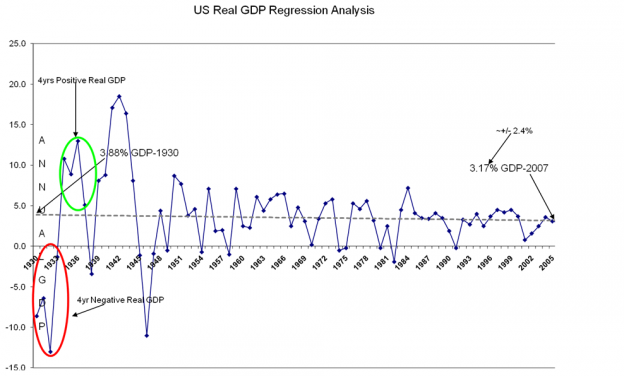

Current views label Hoover as responsible for the 1929 Crash and the Great Depression.. But, the facts if one takes the view that financial crashes come from the over-use of leverage in an economy which suddenly enters default on economic exhaustion offers a different view. Crashes, financial panics and so called “Black Swans”, if one takes the time to examine the evidence that is available, always follow long periods in which leverage is added to the economy. Leverage is used by both producers and consumers to exaggerate supply and demand above historical levels. Leverage, having produced seemingly extraordinary enrichment to many, becomes seen as the “new normal” and market participants enter a period of excess speculation involving even greater leverage that may expand the economy for an additional period. The economy however can only grow at a certain pace and if it is pushed to excess for any period it has always corrected so that a measurable average has been maintained. It is helpful to think of the economy as having a “natural rate of return” which reflects the nature of society’s structure. In the United States this has been roughly 3.9% in the early 1930s to just over 3% today. Growth rates decline as economic size increases. A period of growth above the natural trend at the time will be followed by a period of growth below the natural trend till the excess production (supply) has been brought into balance with sustainable demand. One can see this below in the chart of US Real GDP Regression Analysis derived from Bureau of Economic Analysis.

(NOTE: Economic data measurement did not truly begin till WWII and series that include periods prior to WWII have been reconstructed from the data available. However, this data has been thoroughly researched and revised and is likely a fair representation of past economic trends.)

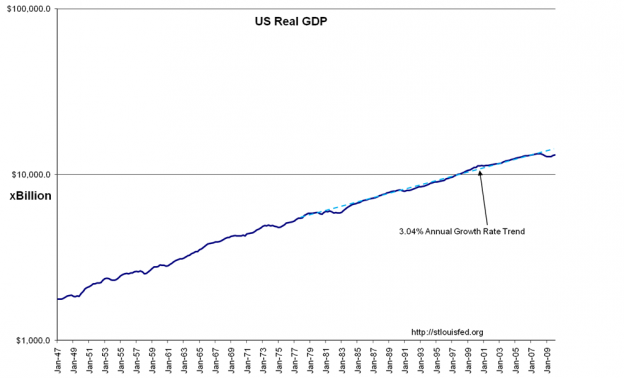

A better number for the current pace of US Real GDP can be derived by the simple drawing of a trend line as in the following chart. The trend line drawn by hand ignores the periods of over/under performance that a purely mathematical analysis would include. The Real GDP trend is ~3.04% This should be viewed as the natural rate of the US economy at present and any excess will be followed by a period of under-performance till the long term trend is renewed. This should be viewed as the “natural rate” for the US as a democratic society. A socialistic society such as France has a Real GDP ~2%.

hroughout history governments have for various reasons promoted specific economic objectives. In all instances these programs interfered with the Supply/Demand inputs that would normally direct the application of economic resources. The term “Command Economy” is applied to those government efforts that attempt to direct economic activity towards specific ends. The resiliency of human beings to survive and produce even under some of the worst of government schemes is a testament to our ingenuity. All of these Command Economy efforts eventually fail as has been witnessed of the former Communist and highly socialistic nations of the past even though it sometimes takes what seems a considerable period. If one can expand one’s historical view to several thousand years, one can see one’s current position as being part of a process of human social evolution which can be described as “two steps forward and one step back”. US history has had multiple financial panics and/or crashes. Each can be ascribed as due to a far less than perfect understanding of the effects of government initiatives and an over-use of leverage. The Crash of 1929 has long been blamed on Herbert Hoover, but in actuality it had the same causality.

The beginnings of the 1929 Crash was in the 1907 Panic and a desire to apply regulation to the financial system to prevent future panics by establishing the Federal Reserve in 1913. Woodrow Wilson in his First Annual Message to Congress December 2, 1913 believed that a significant sector of the economy, i.e. farmers, should be treated differently than they had in the past. Wilson made the American farmer as one focus of his administration and his goal was to extend substantial credit to this group whom bankers had avoided. Wilson specifically indicated that credit should be issued based on criteria other than the ability to pay it back:

“…the security he gives is of a character not known in the broker’s office or as familiarly as it might be on the counter of the banker.”

The relevant excerpt from this message is below.

“I present to you, in addition, the urgent necessity that special provision be made also for facilitating the credits needed by the farmers of the country. The pending currency bill does the farmers a great service. It puts them upon an equal footing with other business men and masters of enterprise, as it should; and upon its passage they will find themselves quit of many of the difficulties which now hamper them in the field of credit. The farmers, of course, ask and should be given no special privilege, such as extending to them the credit of the Government itself. What they need and should obtain is legislation which will make their own abundant and substantial credit resources available as a foundation for joint, concerted local action in their own behalf in getting the capital they must use. It is to this we should now address ourselves.It has, singularly enough, come to pass that we have allowed the industry of our farms to lag behind the other activities of the country in its development. I need not stop to tell you how fundamental to the life of the Nation is the production of its food. Our thoughts may ordinarily be concentrated upon the cities and the hives of industry, upon the cries of the crowded market place and the clangor of the factory, but it is from the quiet interspaces of the open valleys and the free hillsides that we draw the sources of life and of prosperity, from the farm and the ranch, from the forest and the mine. Without these every street would be silent, every office deserted, every factory fallen into disrepair. And yet the farmer does not stand upon the same footing with the forester and the miner in the market of credit. He is the servant of the seasons. Nature determines how long he must wait for his crops, and will not be hurried in her processes. He may give his note, but the season of its maturity depends upon the season when his crop matures, lies at the gates of the market where his products are sold. And the security he gives is of a character not known in the broker’s office or as familiarly as it might be on the counter of the banker.” Woodrow Wilson First Annual Message to Congress December 2, 1913

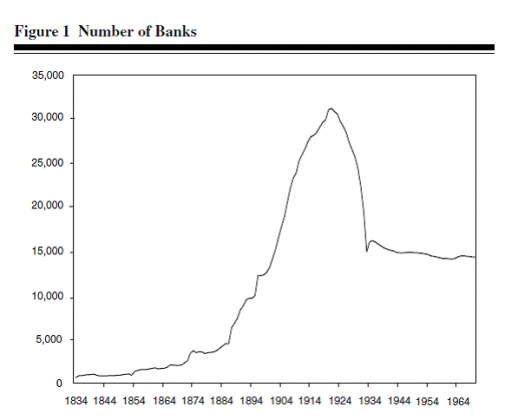

The Wilson initiative received a considerable boost when on July 28, 1914 WWI began. As the farm land in Europe became devastated and abandoned to forces of war, Europe turned to the US as a major source for food and clothing. This created strong demand of US agricultural goods initially to feed and clothe the devastated people of Europe, but later demand increased yet again to support US troops and afterwards was needed to continue to support Europe while it recovered.. Coincidentally farm mechanization (tractors with tillers, planters and harvesters) coupled with a new lower cost process for producing fertilizer turned US farms into highly productive factories. Lending exploded supported by President Wilson’s imperatives as did the number of banks with 1920 total reaching ~31,000 –see the chart labeled Figure 1 Number of Banks.

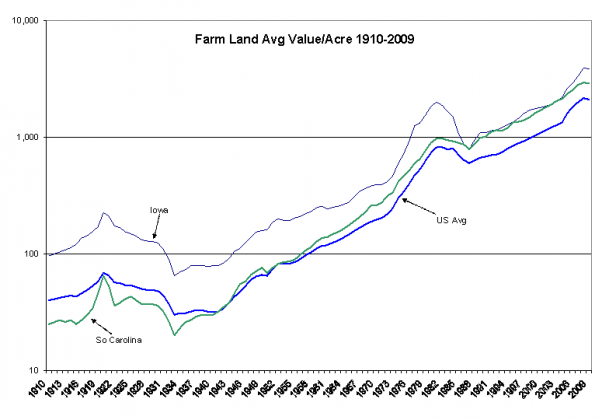

Land prices soared from 1916-1922 as investors joined in speculative frenzy-see the chart Farm Land Avg. Value/Acre 1910-2009.

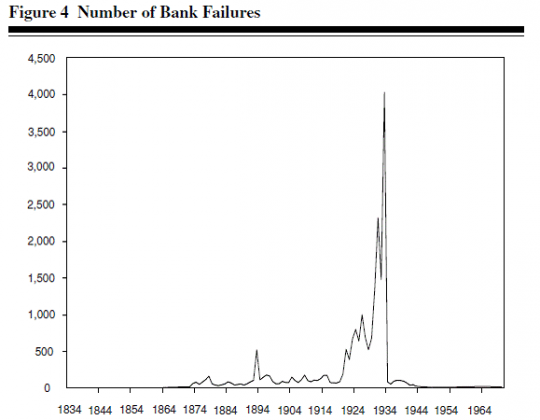

As we all know WWI ended November 11, 1918. The earlier speculation led to excess in the production of agricultural goods which once supply exceeded demand as European farming recovered drove prices down. This in turn drove down the value of land, farms and equipment in the period 1922-1934. With the deadly combination of excessive leverage employed and the diminishing required cash flows from lowered crop and land prices that ensued, the banks began to fail in 1921. Well before the 1929 Crash some 600 banks failed each year on average from 1920-1929-see the chart labeled Figure 4 Number of Bank Failures.

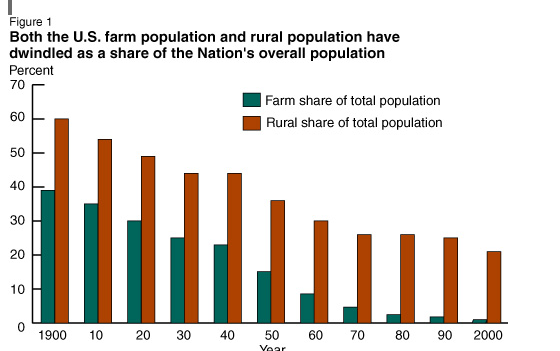

Not only did this destroy these specific farming enterprises, but each bank failure also took the capital and the life savings of the respective bank depositors.. These were mostly rural banks focused on agricultural communities.~30% of the 1920 population was involved in farming which was still significant at the 25% level in 1930-see chart labeled Both the U.S. farm population and rural population have dwindled as a share of the National overall population.

Hoover as Commerce Secretary under Harding and then under Coolidge tried to support agricultural prices with various schemes to no avail. When he became President in 1928, he continued to try to help farmers. He probably contributed to the Great Depression not by “not doing anything” as has commonly been stated in political circles, but by doing too much in providing price supports from 1921-1928. Hoover as Commerce Secretary should have let the speculative excess correct through natural selection of Supply/Demand forces. The 1929 Crash was simply the nudge required to topple the house of cards that represented a highly leveraged and speculative era which had begun with Wilson’s agricultural initiative to bring the farming community into the folds of the country. Approximately 45% of the US population resided in rural communities in 1930 and their savings were effectively wiped out with the collapse of the banks.

We have had 3 major Real Estate collapses in the last 100yrs with each due to excess leverage and investor mania, the 1920’s, the late 1980’s and our recent experience. Each has its roots in government attempts at social engineering

The significant difference in the current debacle versus the 1929 Crash was the formation of the FDIC with the Banking Act of 1933 which guaranteed individual savings in those banks under Federal Reserve regulation. The FDIC is a very powerful force in preventing bank runs and preserving individual savings. The FDIC was immediately effective in 1935 once it began operation and we have not had a comparable destruction of individual wealth since!