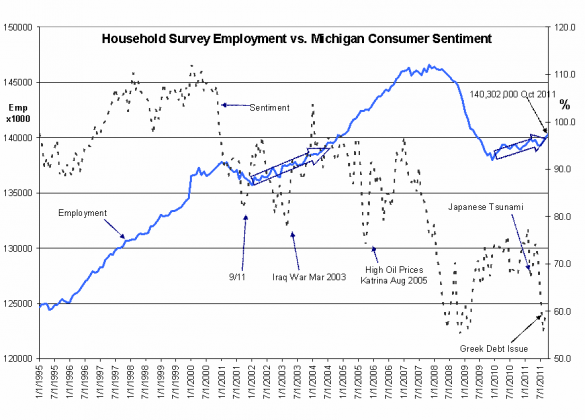

I think it is obvious the correlation here, despite that way it is portrayed in the media is virtually inconsequential. Employment reflects underlying economic activity and sentiment simply reflects people’s reaction to extraneous events that may or may not have any effect on real US activity. There are time sentiment moves with employment and just as many times (like now) they move in opposite directions.

“Davidson” submits:

The Establishment and Household Surveys were reported this morning each with increases that reflect a growing employment base. The economy continues to expand.

The Establishment Survey reported an increase of 80,000 in October but revised Sept higher by 55,000 and Aug higher by 47,000 for a total increase to the rolls of 182,000. Interestingly, the headlines today indicate disappointment as many ignored the higher revisions in earlier months even though they are equally important to understanding the trend.

The Household Survey data had a 277,000 increase in October and as is typical no revision to earlier releases. However, there are statistical revisions from tax rolls and other sources in the works that are reported to cause a rise in all months to be reported shortly. This index has periodic revisions which does not affect the current trend. The Household Survey is shown below with the Michigan Consumer Sentiment Index. It can be seen that sentiment has little effect on employment (employment is a good proxy for economic activity).

I continue to remain quite positive on equities and negative on fixed income with their yields being historically low. I continue to recommend investors add to their portfolios while the markets are depressed in the face of the economic uptrend. Historically poor sentiment/rising economic activity has always signaled an attractive entry point for investors.