I said it before and it bears repeating…. Brian Moynihan could get up out of his chair in Charlotte, WALK up the Atlantic ocean to NYC and the newspapers would write, “Brian Moynihan can’t swim..”, either that or they would say “Moynihan’s afraid to fly”…either way the central point is missed…

Brian Moynihan just has to get used to the fact nothing, and I mean NOTHING he does will be looked at as good. It is to bad because he is actually doing a very good job fixing the steaming pile of excrement Ken Lewis left him.

So what’s behind the latest reversal? The rational for Bank of America’s common stock issuance and debt raising is sound: It plans to use the proceeds to redeem trust preferred securities, a form of subordinated debt, and preferred stock. This, as Bank of America noted in its latest quarterly filing, will reduce interest expense and dividends paid on preferred stock. In some cases, these payout rates are more than 8%.

Although Bank of America will pay a premium to redeem the instruments, it likely won’t pay par. That means the purchases should be accretive to earnings and book value. More importantly, the move will increase the bank’s common equity, while also retiring instruments that don’t help capital ratios under new regulatory rules.

Based on current prices, Bank of America could potentially raise as much as $2.7 billion from stock sales. The bank also said it would look to issue about $3 billion in senior debt to fund preferred purchases. The 400 million new shares would result in dilution of just under 4%. That’s not too painful, especially since the impact on earnings per share should be less due to the reduced interest and dividend costs.

Now, of course there is no mention that $WFC, & $JPM also scrapped plans for debit card fees. In fact, they were actually testing the plan and charging consumers, $BAC was not. In fact, $BAC was simply responding to what it looked like other competitors were going to do. But, hated as they are, they caught the most flack for it. Even the decision to not charge the fee is a negative. Get the logic? Not doing something people hate is now wrong…..

Now to the issuance of common stock. Reverse this. $BAC is going to buy back preferred paying as high as 8%, they will do so below par and by doing that, they will increase earnings due to lower interest/dividend expenses AND increase capital ratios under Basel. The question that needs to be asked, is….why wouldn’t they?

Now in order to accomplish this, they are going to issue ~$3B in debt (this is treated differently than preferred shares under Basil). But wait, why wouldn’t we buy back more of it if we can? We can’t use cash on hand as that is counter to what we are trying to accomplish regarding ratios. The only other solution is issue more common shares. There isn’t a “need” to do this as if the bank is desperate, they “want” to do this for the above reasons.

Later in the article the Buffett deal is brought up. Explain to me how issuing Buffet 6% preferred and then buying back 8% preferred is a bad deal? If my math is right doesn’t that mean net/net that saves the bank $100M in interest annually? Also, how is a 4% dilution bad when it dramatically increases capital ratios and adds stability to the bank? The article goes on to lament why this was not done earlier when the stock was higher (less dilution) in I guess July. . Well the most likely reason is the bond prices now….as the filing says (emphasis mine):

During the third quarter, global economic uncertainty and volatility continued as described more fully in the Executive Summary – Third Quarter 2011 Economic and Business Environment discussion on page 7. Concerns over these and other issues contributed to a widening of credit spreads for many financial institutions, including the Corporation, resulting in lowering of market values of debt and preferred stock issued by financial institutions. The uncertainty in the market evidenced by, among other things, volatility in credit spread movements, makes it economically advantageous at this time to consider retirement of issued junior subordinated debt and preferred stock. As a result of these matters, we intend to explore the issuance of common stock and senior notes in exchange for shares of preferred stock and, subject to any required amendments to the applicable governing documents, certain trust preferred capital debt securities (Trust Securities) issued by unconsolidated trust companies, in privately negotiated transactions.

If we pursue the exchange of Trust Securities, we would immediately use the purchased Trust Securities to retire a corresponding amount of our junior subordinated debt that we previously issued to the unconsolidated trust companies. These transactions would increase Tier 1 common capital and, on an after−tax basis, reduce the combined level of interest expense and dividends paid on the combined junior subordinated debt and preferred stock. The senior notes and common stock would be recorded at fair value at issuance, which is expected to be less than the par and carrying value of the preferred stock and/or junior subordinated debt, which would result in the exchanges being accretive to earnings per common share for the period in which completed. The ultimate impact on earnings per common share is not expected to be significant for periods subsequent to the exchange and will not be known until the level of earnings per common share for the period and the exact combination of exchanged preferred stock and Trust Securities are known. We will not issue more than 400 million shares of common stock or $3 billion in new senior notes in connection with these exchanges.

Right now the stock trades at 50% of tangible book value. That means a fair value for it is essentially double the current price. Why? Confidence and a whole lot of misinformation (see last weeks post on CDS exposure and banks). What would go to restore some confidence? I am of the opinion lower debt, lower interest expense and higher Tier 1 capital levels matter FAR more here than a possible (notice $BAC said they would not sell more than 400M shares) 4% dilution…..In this case 4% here is almost irrelevant.

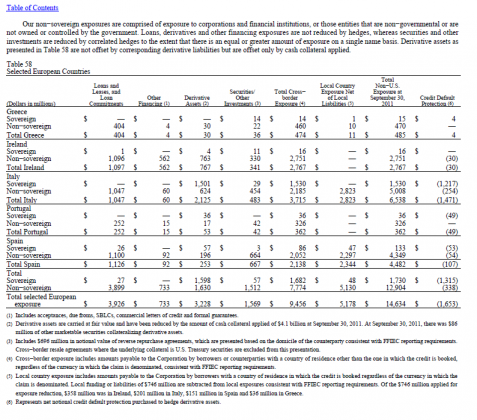

On another note…..Since the PIIGS are in the news second by excruciating second, it is worth noting $BAC’s NET exposure to sovereigns there:

In case the image is too small there, the total NET exposure to the PIIGS is $1.3B sovereign and $350M non sovereign…..in other words, virtually nothing