As a preamble to this here is a study from the Kansas City Fed: Housing Is The Business Cycle

“Davidson” submits

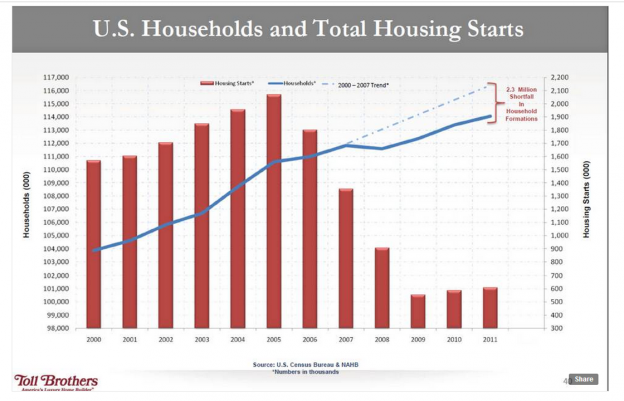

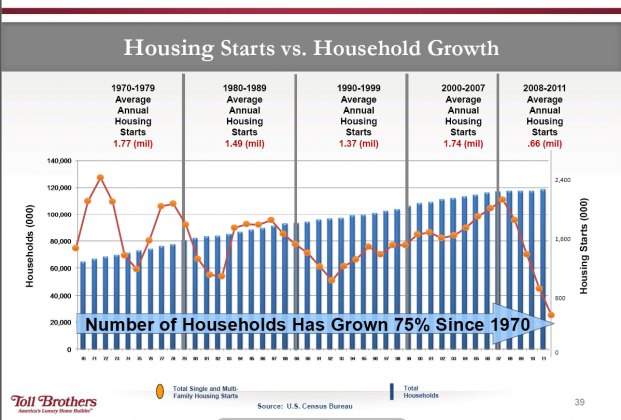

I thought this slide from Toll Brothers* recent presentgation at an investor conference would prove educational to you showing the key element of housing demand, Household Formation. There is a long term relationship between demand for housing and its supply as measured by Single-Family Housing Starts. Toll Brothers’ business rises and falls based on this relationship as do all home builders. This industry has a multiplier effect because 1 new Residential Construction Employee = 8 other newly employed in the economy precisely because new homes at an avg cost of ~$260,000 in the current economy incorporate a varied mix of skills and materials which require mining, manufacturing, assembly, welding, cutting, digging, selling, financing, appraising, taxing, accounting……..and too many more to enumerate. I think you get the idea!

Net/Net, Housing is an important part of our economic activity.

The long term trend places New Single-Family Housing Starts at the 1.2mil annual pace as an average. Please keep in mind that in the current environment lending has been tight and mostly aimed at Prime Borrowers. If lending were to reflect normal underwriting standards to average home buyers of year’s past, the Atlantic Federal Reserve estimates that we would fairly quickly return to the 1.2mil New Single-Family Home Start pace. They indicated that lending standards could reasonably be adjusted to permit the 50% of potential home owners now currently excluded from the housing marketg to enter.

This chart is a good representation of our supply/demand situation and why the “Fiscal Cliff” is not the issue many indicate. What matters much more than taxes is the level of bank lending in the economy. Today, lending remains relatively tight. It is not likely to become tighter. Toll Brothers indicated that their business is expanding rapidly. This is a good sign that lending standards are easing somewhat as regulators and bankers become more comfortable with economic conditions. *Please note that this is not a recommendation to buy/sell Toll Brothers. It is simply used as an example for explaining economic concepts.

The NAHB HMI index, Housing Starts and Household Survey reports will be release over the next couple of weeks. I expect these reports to reflect continued economic expansion.

The basic driver of Household Formation is quite simple. Couples fall in love and want places of their own. It is impossible to stop this behavior!!(From an investor’s point of view this is as good as it gets in forecasting supply/demand)

Optimism remains the best investment stance!!