I’m always amazed at people ability to take relatively simple things and make then inordinately complicated. For the better part of two years each week people have been riveted by the payroll number and whether it would show an increase or a decrease. While I am not one who cares what the weekly numbers say (they are always materially revised), I do care about the trend, are we in aggregate adding or losing jobs? By following new auto sales and housing starts, we effectively cover most of the US economy. From that we will know what the employment trends will be. Housing and auto sales break in either direction before it shows up in the payroll numbers. Since they are improving (and by every measure housing is accelerating), we can expect continued positive employment numbers.

It really has been that simple…

“Davidson” submits:

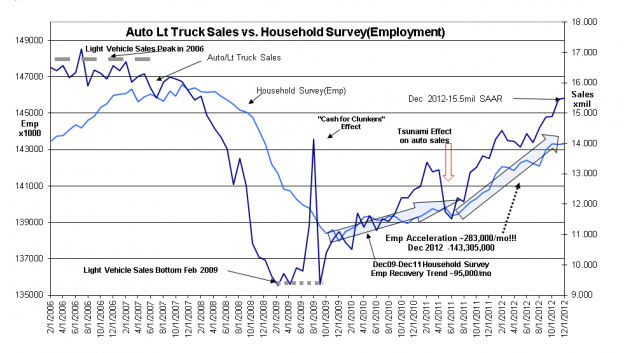

The Bureau of Labor Statistics reported December 2012 employment this morning with the Establishment Survey up 155,000 and the Household Survey up 28,000.

Auto and Light Truck Sales were reported yesterday with the SAAR(seasonally Adjusted Annual Rate) estimated between 15.4 and 15.7mil by various groups. The official number should be available in 10-12days, I used 15.5milSAAR in the chart below. The pace was deemed by most as healthy and a nice surprise considering the expected effect of the “Fiscal Cliff” discussions.

What is important to note is that both Auto&Lt Truck Sales and Employment trends are intact. This remains very positive for equity investors.

One reply on “More on Autos, Housing and Employment”

[…] More on Autos, Housing and Employment Value Plays […]