“Davidson” submits:

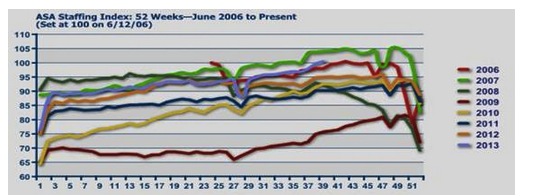

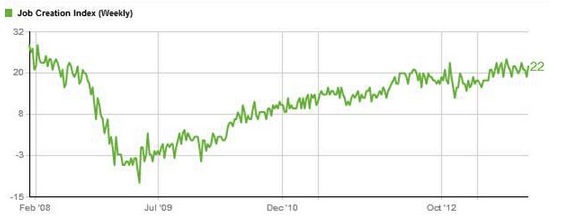

Even without the major economic indicators from the various government agencies we have multiple economic markers from other sources. As the Conference Board’s HWOL Index showed last week, the employment indicators from the American Staffing Association(ASA Staffing Index) at 100, ASA Staffing Index, and the Gallup Job Creation Index at 22, Gallup Job Creation Index, continue to forecast economic expansion. The ASA Staffing Index for 2013 is represented by the PURPLE-BLUE LINE in the chart below.

Each of these indicators provides a 6mos-12mos forecast of general economic and employment trends. Trends are headed higher!

It is the big picture which matters most to serious investors. There are always many ebbs and flows during economic expansions. The traders attempt to capture these many nuances thru active changes in portfolio holdings. Sometimes traders seem hyperactive! Serious students of the market learn very quickly that short term market direction is impossible to predict. However, if one delves deeply enough, one becomes aware that it is the broad economic factors which eventually become the market’s main drivers. These drivers are what we should follow.

The order of events which one learns is that light weight vehicle sales tends most often to signal a turn in the markets at major lows. Light Weight Vehicle Sales, Help Wanted Online, Temporary Staffing, Gallup Job Creation Index and others forecast economic trends up to 18mos into the future. These significant market turns are not predicted with a precise date and price in mind, but with signals strong enough to let us enter the markets near the major lows and exit near the major highs. And, as the economy goes, so do stock prices over the long term!

As the economy goes, so do stock prices over the long term!

These 2 economic measures capture a portion of our recent turmoil. There is no sign that the US economy is slowing. The best advice and the most prudent for long term returns in my opinion is to at least hold existing equity positions and, if possible, to add equity should the markets shift lower. The market may or may not dip the next 30dys. There are enough opinions on either side of this question that no advice seems better than any advice. But, while one cannot predict a market’s short term direction, one can predict the long term!