“Davidson” submits:

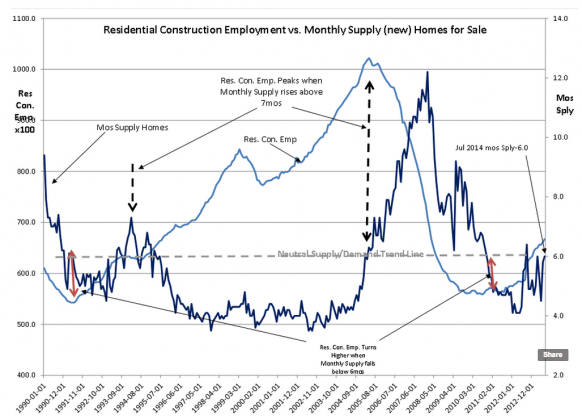

Monthly Supply of New Homes for Sale rises to 6.0, but so does Residential Const Employment- look at the trend of the LIGHT BLUE LINE in the chart below.

We are getting steady growth in Residential Construction Employment. Because construction projects are typically financed(not paid for with cash), they tend to reflect the bank lending climate. At the moment conditions continue to be tight with only the best borrowers being able to obtain financing. Nonetheless, Residential Construction Employment continues to trend higher which means that good paying jobs are being created. It would certainly be nice to see this accelerate further, but as more individuals enter the workforce, individual credit qualifications improve and bank lending even with restrictive lending standards will find that there are more individuals who qualify over time.

Add to this good news the historical relationship which the Mtg Bankers Assoc found several years ago in which each new construction job equated to another 7 elsewhere in the economy. This is because construction projects once started flood the economy with spending in many areas of the economy.

The economic news remains on trend for economic expansion in the months ahead. The talk of economic correction does not have support from many measures of economic activity. With construction just lifting off we very likely will experience improved construction hiring for the next 5yrs-7yrs. As long as the economy continues to expand, market corrections tend to be small and short lived ($SPY) . It is the continued ‘good economic news’ which drives market psychology over the longer term.