“Davidson” submits:

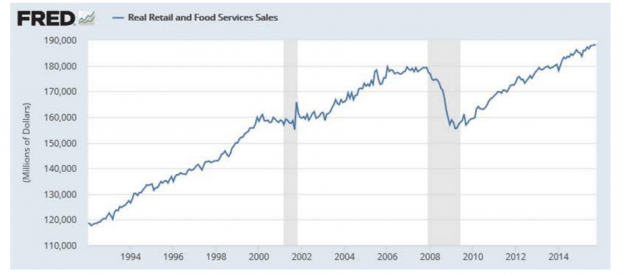

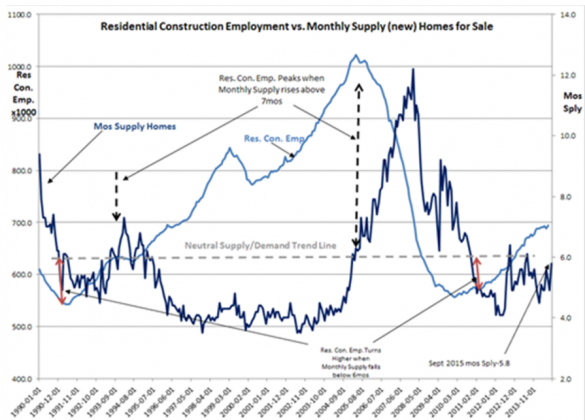

Retail Sales continue in a strong uptrend and have a good correlation to Single-Family Housing activity. Once the monthly supply of New Homes for Sale(Single-Family) ($XHB)crosses above 6mos of Supply, Retail Sales begin to slow markedly.

It has to do with bank lending slowing down in the mtg arena

I placed both Retail Sales and the recent Monthly Supply of New Homes for Sale charts below.

We are nowhere close to slowing Retail Sales and credit for mtg lending is expanding. At the current pace, it looks like we have 5yr+ of expansion ahead. Geopolitical events have generally had a greater impact on short term market psychology (short term market prices) ($SPY) and little impact on economic trends. This holds unless a major power lobs missals at the US. There would be a significant effect if the US mobilized to respond to an aggressor.

Even if ISIS lands an attack in the US, it does not qualify as such an event. 9/11 was a great shock, but economic activity was not slowed. The recovery from recession in the US began the month of the World Trade Ctr attack even though markets did not turn around till 12mo later Sept 2002.