The market in no way is overvalued

“Davidson” Submits:

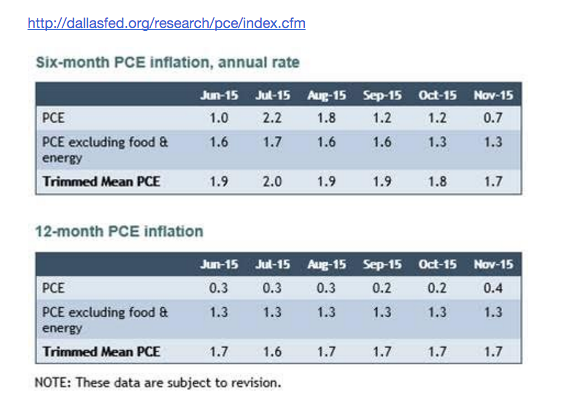

The Dallas Fed reported 12mo Trimmed Mean PCE(Inflation) at 1.7% which is inline with what we have throughout 2015-see the data table.

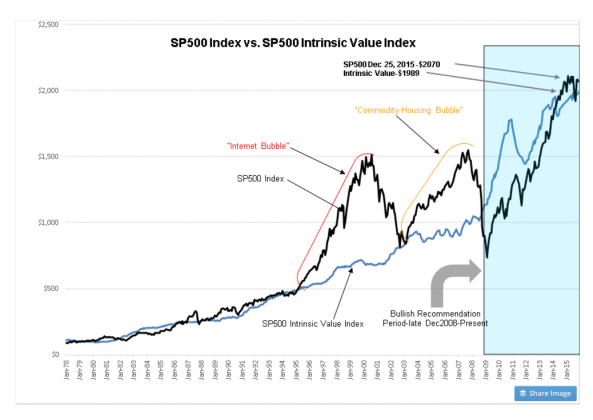

The SP500 Intrinsic Value Index shifts to $1,989 as shown in the chart. With the SP500 at roughly $2,070, the market reflects a relatively low level of general speculation. However, if one examines specific situations, one finds that the top 10 performing issues in the SP500 year-to-date reported 24% return. This is in the face of the other 490 issues showing an average loss of -2.6%. It should be obvious that gains are concentrated in very few issues commonly referred to as Momentum Issues whose prices have been driven by Momentum Investors. It is easy to see which issues they are by listening to the media.

With the least price pull-back in this small group of issues, the noise immediately rises calling for recession or major market correction. Even though Momentum Investors dominate the media, economic fundamentals do not factor into their analyses. Fundamentals are the first to alert us to potential market correction. It seems that fewer and fewer investors use fundamentals. This is why we routinely seem to get a couple of calls each year that the market is at a ‘Top’ or a ‘Correction’ is just around the corner. When markets do not correct as forecast, they move on to their next forecasts and the media carries them as loudly as before. It makes for good TV advertising revenue.

Being a Value Investor, I do track and analyze fundamentals. Fundamentals lead to long term investment perceptions which currently indicate that most equities are undervalued. Fundamentals remain in uptrends without any indications of a slowing near term.