“Davidson” submits:

Job Openings and Temp Help Svcs are a good harbinger of future economic activity.

Which comes first, the ‘Chicken’ or the ‘Egg’? What actually comes first is the desire to improve one’s own and one’s family’s standard of living. Desire being part of human psychology is one of those intangibles which we have yet been able to measure. Employment through which individuals improve their standard of living can be measured. There are multiple employment measures two of which are called Job Openings and Temporary Help Svcs. Both continue to indicate economic expansion.

As are all economic measures, these measures have variability associated with statistical methods. What is important is their correlation with other economic measures over time and the current 6mo+ trend. All appear to be trending higher which equates to generally higher employment, likely higher compensation at this point in the economic expansion and future economic expansion.

More employment = higher personal income = greater consumption and higher GDP

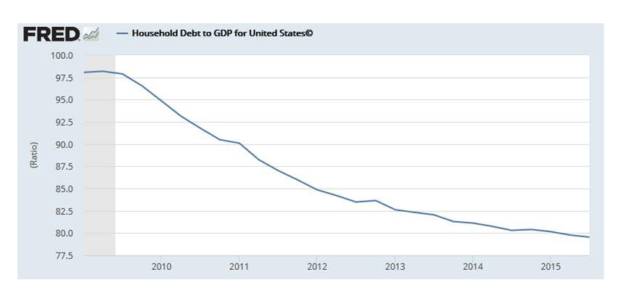

There have been multiple calls for recession and even economic collapse in 2016 from highly respected investors. These individuals are Macro-Momentum Investors in my opinion. The reason for their pessimism is often that economies cannot improve for more than 5yrs-7yrs without some implosion. They measure our current economy at 7yrs expansion from 2009 to 2016. There is nothing in the economic rule book which says expansions can only last 5yrs-7yrs. Economic activity has always ended when consumers became overly indebted and financial institutions slowed their lending pace as a result. Economic corrections have always followed.

The current expansion reveals little excess indebtedness by households. Current measures show Household Indebtedness to GDP continues to decline. The current consumer balance sheet condition is excellent and getting better. Employment is trending higher. History and economics show that it is the US consumer which supports the global economy including China.

Those calling for imminent economic collapse are Macro-Momentum Investors. They view markets from a ‘Top-Down’ perspective. They do not see the employment and consumer balance details which are part of the fundamentals which drive the individual desire to improve standards of living.

In my opinion, there is much to like in these fundamental measures and I expect higher equity markets in the year ahead.

History supports expectations for higher stock markets.

Economic Expansion = Higher Stock Markets