If this comes to fruition then we may be looking at significantly higher prices ahead……

“Davidson” submits:

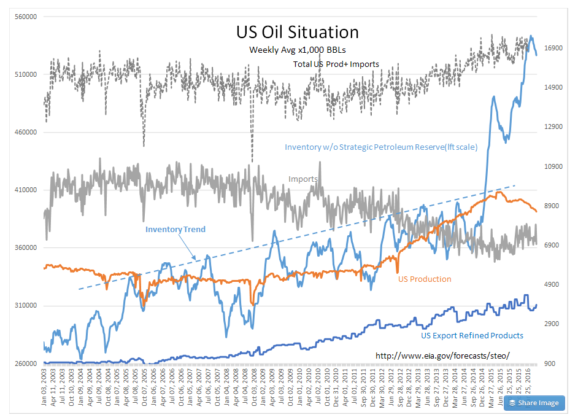

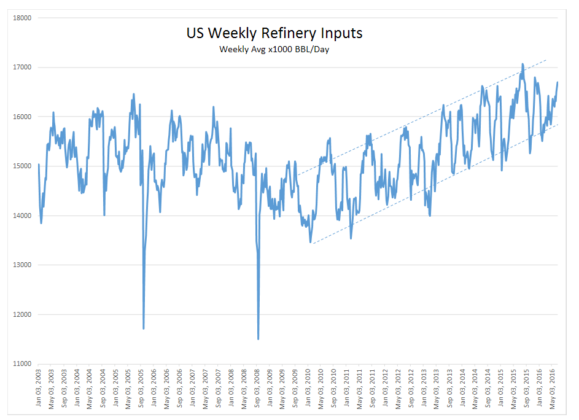

Two charts tell the story of the past several years. US oil ($OIL) ($USO) production has fallen to 8.622mil BBL/Day(roughly 1mm BBL/Day lower than June 2015 peak of 9.61mil BBL/Day)with falling prices. Yet, US imported to build inventories by raising imports. A driver of inventories appears to be the need to supply refinery inputs which saw substantial upgrades, some of which are coming on line in 2016.

I believe many read rising inventories as due to overproduction when this was a planned preparation for expanded refinery output.

Now that oil prices are rising, few are talking about inventories which remain at record levels. Refinery Inputs looks like they are about mid-trend this past week at 16.7mil BBL/Day. Seeing this rise over 17mil BBL/Day appears likely the next 6mos.

My observation is that the market fears of the past 2yrs were connected to oil price changes due to changes in the US$ currency relationships. The US oil situation appears not to have deviated from the trends the past 10yrs but for US oil production which declined as prices fell.